Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Edition 4ISBN: 978-0078110993 Exercise 36

Harrell and Smith, Inc. 204 Ambulance Street, Anywhere, CA 92345, is a corporation (EIN 57-1234567) formed on January 1, 2007. Information concerning the corporation and its two shareholders follows. Harell and Smith uses the tax/cash basis accounting, did not pay dividends in excess of earnings and profits, has no foreign shareholders, is not publicly traded, and has no NOL carrybacks.

Bruce Harrell (SSN 412-34-5670), 1018 Lexington Downs, Anywhere, CA 92345 is a 60% shareholder. Della Smith (SSN 412-34-5671), 4564 Yates Rd., Anywhere, CA 92345, is a 40% shareholder. Bruce received a dividend of $60,000, and Della received a dividend of $40,000. Both of these dividends are in addition to their salaries.

Harrell and Smith Fuels, Inc.

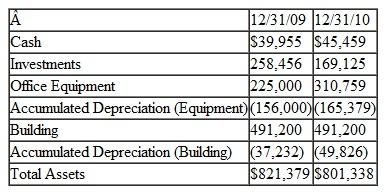

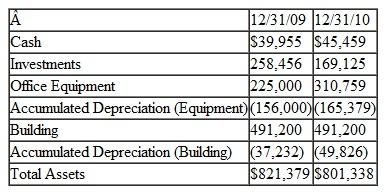

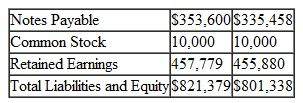

Comparative Balance Sheet

As of December 31, 2009 and December 31, 2010

Assets:

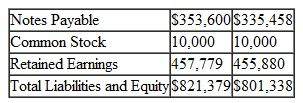

Liabilities and Equity:

Liabilities and Equity:

Harrell and Smith Fuels, Inc.

Harrell and Smith Fuels, Inc.

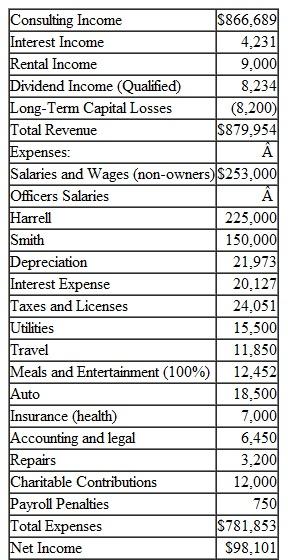

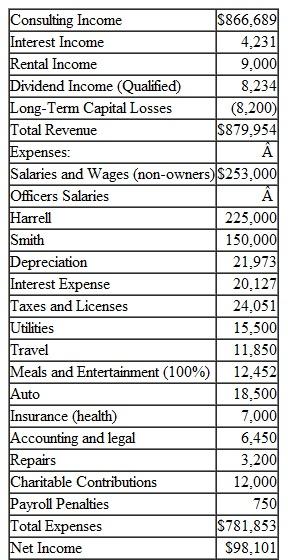

Income Statement

For the Year Ending December 31, 2010

Required: Prepare Form 1120 pages 1-5 for Harrell and Smith, Inc. Schedule D, and Form 4562 can be omitted (the information given is not sufficient to complete these forms).

Required: Prepare Form 1120 pages 1-5 for Harrell and Smith, Inc. Schedule D, and Form 4562 can be omitted (the information given is not sufficient to complete these forms).

***** Insert Form 1120, 5 pages here **********

Bruce Harrell (SSN 412-34-5670), 1018 Lexington Downs, Anywhere, CA 92345 is a 60% shareholder. Della Smith (SSN 412-34-5671), 4564 Yates Rd., Anywhere, CA 92345, is a 40% shareholder. Bruce received a dividend of $60,000, and Della received a dividend of $40,000. Both of these dividends are in addition to their salaries.

Harrell and Smith Fuels, Inc.

Comparative Balance Sheet

As of December 31, 2009 and December 31, 2010

Assets:

Liabilities and Equity:

Liabilities and Equity:  Harrell and Smith Fuels, Inc.

Harrell and Smith Fuels, Inc.Income Statement

For the Year Ending December 31, 2010

Required: Prepare Form 1120 pages 1-5 for Harrell and Smith, Inc. Schedule D, and Form 4562 can be omitted (the information given is not sufficient to complete these forms).

Required: Prepare Form 1120 pages 1-5 for Harrell and Smith, Inc. Schedule D, and Form 4562 can be omitted (the information given is not sufficient to complete these forms).***** Insert Form 1120, 5 pages here **********

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Fundamentals of Taxation 2011 4th Edition by Ana Cruz, Debra Prendergast, Dan Schisler, Michael Deschamps

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255