Financial & Managerial Accounting 13th Edition by Carl Warren , James Reeve,Jonathan Duchac

Edition 13ISBN: 978-1285868776

Financial & Managerial Accounting 13th Edition by Carl Warren , James Reeve,Jonathan Duchac

Edition 13ISBN: 978-1285868776 Exercise 2

Expenses in an IFRS income statement are classified by either their nature or function. The nature of an expense is how the expense would naturally be recorded in a journal entry reflecting the economic benefit received for that expense. Examples include salaries, depreciation, advertising, and utilities. The function of an expense identifies the purpose of the expense, such as a selling expense or an administrative expense.

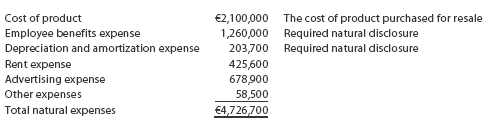

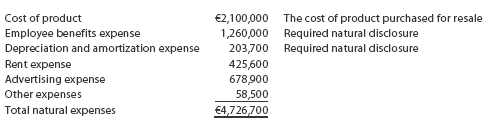

IFRS does not permit the natural and functional classifications to be mixed together on the same statement. That is, all expenses must be classified by either nature or function. However, if a functional classification of expenses is used, a footnote to the income statement must show the natural classification of expenses. To illustrate, because Mornin' Joe International uses the functional classification of expenses in its income statement, it must also show the following natural classification of expenses in a footnote:

IFRS does not permit the natural and functional classifications to be mixed together on the same statement. That is, all expenses must be classified by either nature or function. However, if a functional classification of expenses is used, a footnote to the income statement must show the natural classification of expenses. To illustrate, because Mornin' Joe International uses the functional classification of expenses in its income statement, it must also show the following natural classification of expenses in a footnote:

Explanation

a. Mornin Joe followed liquidity prefere...

Financial & Managerial Accounting 13th Edition by Carl Warren , James Reeve,Jonathan Duchac

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255