Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532 Exercise 20

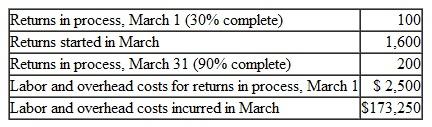

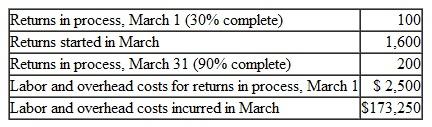

FIFO Method Taxes R Us (TRU), an income tax preparation firm, uses the FIFO method of process costing for the monthly reports. TRU has no materials cost in the preparation of the returns. The following shows its March information:

Required Calculate the following amounts for conversion costs using the FIFO method:

Required Calculate the following amounts for conversion costs using the FIFO method:

1. Equivalent units.

2. Cost per equivalent unit.

3. Cost of completed returns for the month of March.

4. Cost of returns in process as of March 31.

Required Calculate the following amounts for conversion costs using the FIFO method:

Required Calculate the following amounts for conversion costs using the FIFO method:1. Equivalent units.

2. Cost per equivalent unit.

3. Cost of completed returns for the month of March.

4. Cost of returns in process as of March 31.

Explanation

FIFO method of process costing:

FIFO me...

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255