Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532 Exercise 19

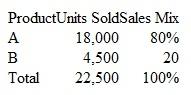

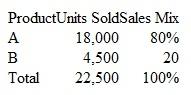

Multiple Products Most businesses sell several products at varying prices. The products often have different unit variable costs. Thus, the total profit and the breakeven point depend on the proportions in which the products are sold. Sales mix is the relative contribution of sales among various products sold by a firm. Assume that the sales of Jordan, Inc., are the following for a typical year:

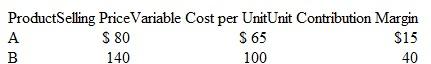

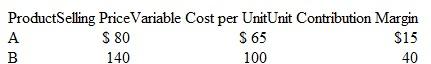

Assume the following unit selling prices and unit variable costs:

Assume the following unit selling prices and unit variable costs:

Fixed costs are $400,000 per year, of which $60,000 are batch-related and $340,000 are facilitiesrelated. Assume sales mix is constant in units.

Fixed costs are $400,000 per year, of which $60,000 are batch-related and $340,000 are facilitiesrelated. Assume sales mix is constant in units.

Required

1. Determine the breakeven point in units.

2. Determine the number of units required for a before-tax net profit of $40,000.

Assume the following unit selling prices and unit variable costs:

Assume the following unit selling prices and unit variable costs: Fixed costs are $400,000 per year, of which $60,000 are batch-related and $340,000 are facilitiesrelated. Assume sales mix is constant in units.

Fixed costs are $400,000 per year, of which $60,000 are batch-related and $340,000 are facilitiesrelated. Assume sales mix is constant in units.Required

1. Determine the breakeven point in units.

2. Determine the number of units required for a before-tax net profit of $40,000.

Explanation

Breakeven Point:

Break even for the com...

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255