Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532 Exercise 60

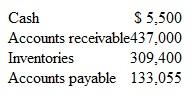

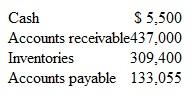

Retailer Budget D. Tomlinson Retail seeks your assistance in developing cash and other budget information for May, June, and July. The store expects to have the following balances at the end of April:

The firm follows these guidelines in preparing its budgets:

The firm follows these guidelines in preparing its budgets:

• Sales. All sales are on credit with terms of 3/10, n/30. Tomlinson bills customers on the last day of each month. The firm books receivables at gross amounts and collects 60 percent of the billings within the discount period, 25 percent by the end of the month, and 9 percent by the end of the second month. The firm's experience suggests that 6 percent is likely to be uncollectible and is written off at the end of the third month.

• Purchases and expenses. All purchases and expenses are on open account. The firm pays its payables over a two-month period with 54 percent paid in the month of purchase. Each month's units of ending inventory should equal 130 percent of the next month's cost of sales. The cost of each unit of inventory is $20. Selling and general and administrative expenses, of which $2,000 is depreciation, equal 15 percent of the current month's sales.

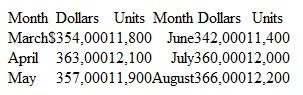

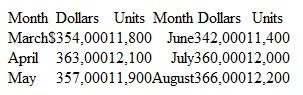

Actual and projected sales follow:

Required

Required

1. Prepare schedules showing budgeted purchases for May and June.

2. Prepare a schedule showing budgeted cash disbursements during June.

3. Prepare a schedule showing budgeted cash collections during May.

4. Determine gross and net balances of accounts receivable on May 31.

The firm follows these guidelines in preparing its budgets:

The firm follows these guidelines in preparing its budgets:• Sales. All sales are on credit with terms of 3/10, n/30. Tomlinson bills customers on the last day of each month. The firm books receivables at gross amounts and collects 60 percent of the billings within the discount period, 25 percent by the end of the month, and 9 percent by the end of the second month. The firm's experience suggests that 6 percent is likely to be uncollectible and is written off at the end of the third month.

• Purchases and expenses. All purchases and expenses are on open account. The firm pays its payables over a two-month period with 54 percent paid in the month of purchase. Each month's units of ending inventory should equal 130 percent of the next month's cost of sales. The cost of each unit of inventory is $20. Selling and general and administrative expenses, of which $2,000 is depreciation, equal 15 percent of the current month's sales.

Actual and projected sales follow:

Required

Required 1. Prepare schedules showing budgeted purchases for May and June.

2. Prepare a schedule showing budgeted cash disbursements during June.

3. Prepare a schedule showing budgeted cash collections during May.

4. Determine gross and net balances of accounts receivable on May 31.

Explanation

The master budget or annual profit plan ...

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255