Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532 Exercise 16

Budgeting Customer Retention and Insurance-Policy Renewal; Sensitivity Analysis National Insurance company underwrites property insurance for homeowners. You have been charged with the responsibility of developing a portion of the monthly budget for the coming 12-month period for the company.

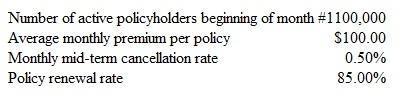

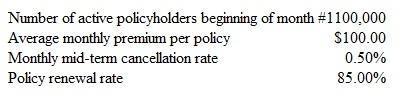

You have collected the following driver volumes, consumption rates, unit resource costs, and other data needed to prepare your 12-month budget for those active policyholders whose policy runs from January to December:

Required

Required

1. Prepare, in good form, a monthly budget for customer retention and insurance premium revenue for the period January through December. Columns in your budget should represent months, while the rows in your budget should consist of the following: number of policyholders at beginning of the month; midterm cancellation rate (%); number of active policyholders at end of the month; average number of active policyholders during the month; average monthly premium per policy; and total premiums earned per month from active policyholders. How many policies are projected to be renewed at the end of the year

2. Within the context of budgeting, what do we mean by the term what-if analysis

3. Recreate the original 12-month budget you prepared in (1) above to reflect what would happen if the policy-renewal rate falls to 80 percent and the monthly midterm cancellation rate increases to 0.75 percent. Of what potential significance is the analysis you just performed

4. What other information or data would be included in the full budget prepared each month for the company

You have collected the following driver volumes, consumption rates, unit resource costs, and other data needed to prepare your 12-month budget for those active policyholders whose policy runs from January to December:

Required

Required 1. Prepare, in good form, a monthly budget for customer retention and insurance premium revenue for the period January through December. Columns in your budget should represent months, while the rows in your budget should consist of the following: number of policyholders at beginning of the month; midterm cancellation rate (%); number of active policyholders at end of the month; average number of active policyholders during the month; average monthly premium per policy; and total premiums earned per month from active policyholders. How many policies are projected to be renewed at the end of the year

2. Within the context of budgeting, what do we mean by the term what-if analysis

3. Recreate the original 12-month budget you prepared in (1) above to reflect what would happen if the policy-renewal rate falls to 80 percent and the monthly midterm cancellation rate increases to 0.75 percent. Of what potential significance is the analysis you just performed

4. What other information or data would be included in the full budget prepared each month for the company

Explanation

Budget:

Budget is a preparation of esti...

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255