Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532 Exercise 15

Proration of Variances Butrico Manufacturing Corporation uses a standard cost system, records materials price variances when raw materials are purchased, and prorates all variances at year-end. Variances associated with direct materials are prorated based on the balances of direct materials in the appropriate accounts, and variances associated with direct labor and manufacturing overhead are prorated to Finished Goods Inventory and CGS on the basis of the relative direct labor cost in these accounts at year-end.

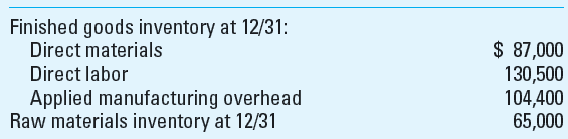

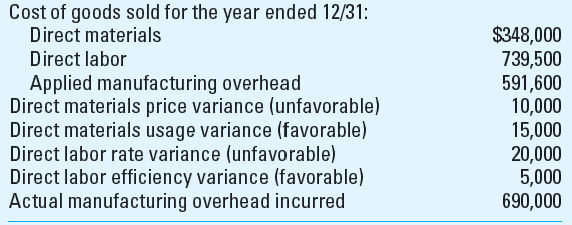

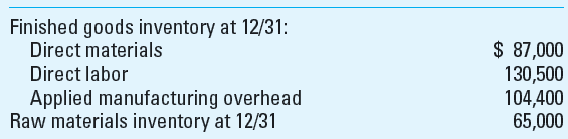

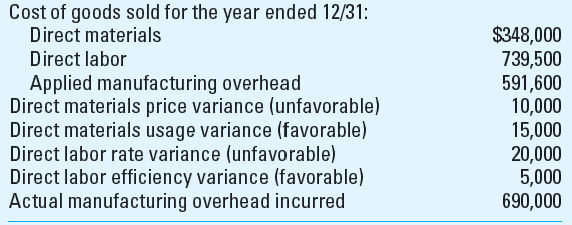

The following Butrico information is for the year ended December 31:

The company had no beginning inventories and no ending work-in-process (WIP) inventory. It applies manufacturing overhead at 80% of standard direct labor cost.

Required

1. Compute the amount of direct materials price variance to be prorated to finished goods inventory at December 31.

2. Compute the total amount of direct materials cost in finished goods inventory at December 31, after all materials variances have been prorated. ( Hint: The correct amount is $85,732.)

3. Compute the total amount of direct labor cost in finished goods inventory at December 31, after all variances have been prorated. ( Hint: The correct amount is $132,750.)

4. Compute the total cost of goods sold for the year ended December 31, after all variances have been prorated. ( Hint: The correct amount is $1,681,678.)

5. How, if at all, would the provisions of GAAP regarding inventory costing (i.e., FASB ASC 330-10- 30, previously SFAS No. 151 -available at www.fasb.org ) bear upon the end-of-period variance disposition question

6. Under absorption costing, explain how reported earnings can be managed by the method used to dispose of (fixed) overhead cost variances at the end of the period.

The following Butrico information is for the year ended December 31:

The company had no beginning inventories and no ending work-in-process (WIP) inventory. It applies manufacturing overhead at 80% of standard direct labor cost.

Required

1. Compute the amount of direct materials price variance to be prorated to finished goods inventory at December 31.

2. Compute the total amount of direct materials cost in finished goods inventory at December 31, after all materials variances have been prorated. ( Hint: The correct amount is $85,732.)

3. Compute the total amount of direct labor cost in finished goods inventory at December 31, after all variances have been prorated. ( Hint: The correct amount is $132,750.)

4. Compute the total cost of goods sold for the year ended December 31, after all variances have been prorated. ( Hint: The correct amount is $1,681,678.)

5. How, if at all, would the provisions of GAAP regarding inventory costing (i.e., FASB ASC 330-10- 30, previously SFAS No. 151 -available at www.fasb.org ) bear upon the end-of-period variance disposition question

6. Under absorption costing, explain how reported earnings can be managed by the method used to dispose of (fixed) overhead cost variances at the end of the period.

Explanation

Variance:

A variance is the difference ...

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255