Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532 Exercise 38

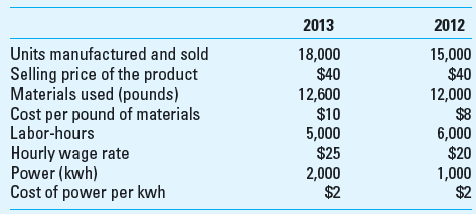

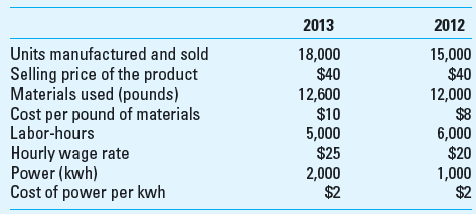

Partial Operational and Financial Productivity In the fourth quarter of 2012 Simpson Company embarked on a major effort to improve productivity. It redesigned products, reengineered manufacturing processes, and offered productivity improvement courses. The effort was completed in the last quarter of 2012. The controller's office has gathered the following yearend data to assess the results of this effort.

Required (in your calculations use 6 significant digits after the decimal point)

1. Prepare a summary contribution approach income statement for each of the two years and calculate the change in operating income.

2. Compute the partial operational productivity ratios for each production factor in 2012 and 2013.

3. Compute the partial financial productivity ratios for each production factor in 2012 and 2013.

4. On the basis of the partial operational and financial productivity you computed, what conclusions can you make about the firm's productivity in 2012 relative to 2013

5. Separate the changes in the partial financial productivity ratio from 2012 to 2013 into productivity changes, input price changes, and output changes.

6. Discuss additional insight on the relative productivity between 2012 and 2013 from the detailed information provided by separating the change in the financial partial productivity ratios.

Required (in your calculations use 6 significant digits after the decimal point)

1. Prepare a summary contribution approach income statement for each of the two years and calculate the change in operating income.

2. Compute the partial operational productivity ratios for each production factor in 2012 and 2013.

3. Compute the partial financial productivity ratios for each production factor in 2012 and 2013.

4. On the basis of the partial operational and financial productivity you computed, what conclusions can you make about the firm's productivity in 2012 relative to 2013

5. Separate the changes in the partial financial productivity ratio from 2012 to 2013 into productivity changes, input price changes, and output changes.

6. Discuss additional insight on the relative productivity between 2012 and 2013 from the detailed information provided by separating the change in the financial partial productivity ratios.

Explanation

Partial operational and financial produc...

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255