Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532 Exercise 2

ROI; Residual Income;

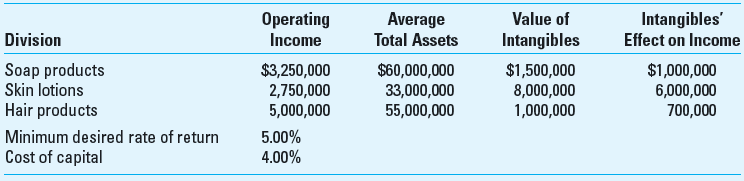

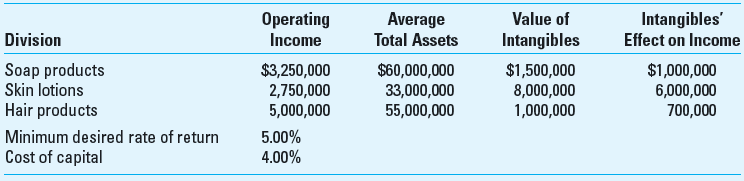

Heather Smith Cosmetics (HSC) manufactures a variety of products and is organized into three divisions (investment centers): soap products, skin lotions, and hair products. Information about the most recent year's operations follows. The information includes the value of intangible assets including research and development, patents, and other innovations that are not included on HSC's balance sheet. Were these intangibles to be included in the financial statements (as they are for

Heather Smith Cosmetics (HSC) manufactures a variety of products and is organized into three divisions (investment centers): soap products, skin lotions, and hair products. Information about the most recent year's operations follows. The information includes the value of intangible assets including research and development, patents, and other innovations that are not included on HSC's balance sheet. Were these intangibles to be included in the financial statements (as they are for

), the increase in the balance sheet and the increase in after-tax operating income would be as given below.

), the increase in the balance sheet and the increase in after-tax operating income would be as given below.

Required

1. Calculate the return on investment (ROI) for each division.

2. Calculate the residual income (RI) for each division.

3. Calculate

for each division and comment on your answers for ROI, RI, and

for each division and comment on your answers for ROI, RI, and

.

.

Heather Smith Cosmetics (HSC) manufactures a variety of products and is organized into three divisions (investment centers): soap products, skin lotions, and hair products. Information about the most recent year's operations follows. The information includes the value of intangible assets including research and development, patents, and other innovations that are not included on HSC's balance sheet. Were these intangibles to be included in the financial statements (as they are for

Heather Smith Cosmetics (HSC) manufactures a variety of products and is organized into three divisions (investment centers): soap products, skin lotions, and hair products. Information about the most recent year's operations follows. The information includes the value of intangible assets including research and development, patents, and other innovations that are not included on HSC's balance sheet. Were these intangibles to be included in the financial statements (as they are for  ), the increase in the balance sheet and the increase in after-tax operating income would be as given below.

), the increase in the balance sheet and the increase in after-tax operating income would be as given below.

Required

1. Calculate the return on investment (ROI) for each division.

2. Calculate the residual income (RI) for each division.

3. Calculate

for each division and comment on your answers for ROI, RI, and

for each division and comment on your answers for ROI, RI, and  .

.Explanation

Here we are provided with the financial ...

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255