Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Edition 6ISBN: 978-0078025532 Exercise 4

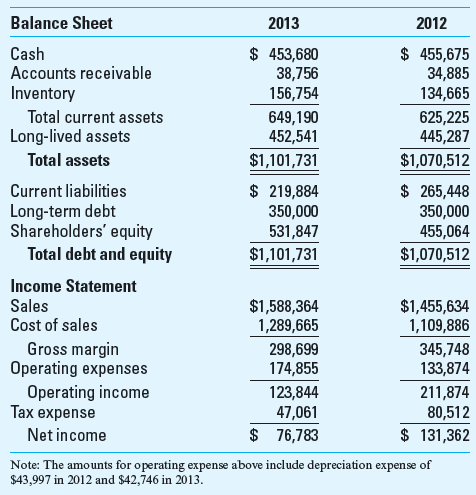

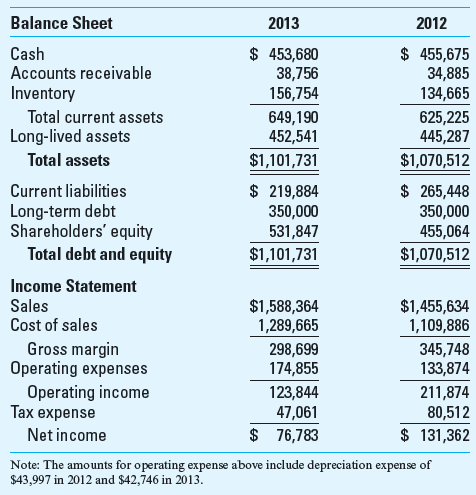

Business Analysis and Business Valuation JJP Autoparts, Inc., a manufacturer of auto parts, experienced a decline in earnings in the recent year and has consulted its accounting firm for an analysis of the firm's financial statements. Additionally, the company knows that its market value has fallen from the prior year, since the share price has fallen from $5.50 at the end of 2012 to $2.34 at the end of 2013. So, JJP also want an analysis of the firm's change in value. The comparative balance sheet and income statement for 2013 follow:

Additional relevant information about JJP is that it uses a cost of capital rate of 5.7%. Also it incurred capital expenditures of $100,000 in 2012 and $50,000 in 2013; there were no cash dividends in either year. The number of outstanding shares is 653,554, the same in both years.

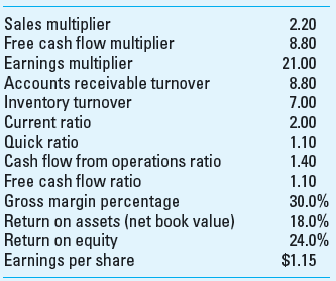

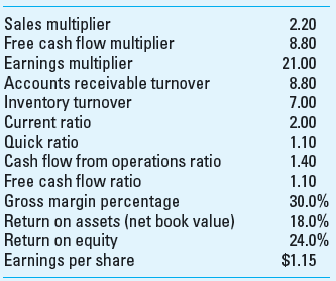

Industry data, the average values for firms in the autoparts industry, follow:

Required:

1. Calculate and interpret the liquidity, cash flow, and profitability ratios for JJP for 2012 and 2013. In your calculations, you may assume that the balance sheet values for 2012 are the same as for the prior year, 2011

2. Develop and interpret a business valuation for JJP for 2012 and 2013 using the methods you think appropriate.

Additional relevant information about JJP is that it uses a cost of capital rate of 5.7%. Also it incurred capital expenditures of $100,000 in 2012 and $50,000 in 2013; there were no cash dividends in either year. The number of outstanding shares is 653,554, the same in both years.

Industry data, the average values for firms in the autoparts industry, follow:

Required:

1. Calculate and interpret the liquidity, cash flow, and profitability ratios for JJP for 2012 and 2013. In your calculations, you may assume that the balance sheet values for 2012 are the same as for the prior year, 2011

2. Develop and interpret a business valuation for JJP for 2012 and 2013 using the methods you think appropriate.

Explanation

Here we are provided with the financial ...

Cost Management 6th Edition by Edward Blocher,David Stout ,Paul Juras,Gary Cokins

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255