Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

Edition 11ISBN: 978-1259535314

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

Edition 11ISBN: 978-1259535314 Exercise 2

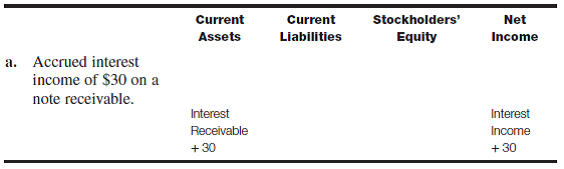

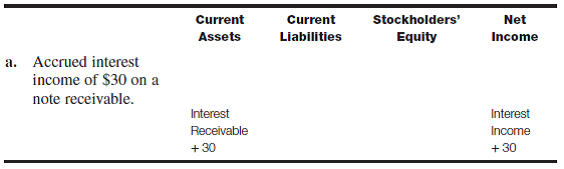

Transaction analysis-various accounts Prepare an answer sheet with the column headings shown here. For each of the following transactions or adjustments, indicate the effect of the transaction or adjustment on the appropriate balance sheet category and on net income by entering for each account affected the account name and amount and indicating whether it is an addition (+) or a subtraction (?). Transaction a has been done as an illustration. Net income is not affected by every transaction. In some cases only one column may be affected because all of the specific accounts affected by the transaction are included in that category.

b. Recorded estimated bad debts in the amount of $1,400.

c. Wrote off an overdue account receivable of $1,040.

d. Converted a customer's $2,400 overdue account receivable into a note.

e. Accrued $96 of interest earned on the note (in d ).

f. Collected the accrued interest (in e ).

g. Recorded $8,000 of sales, 70% of which were on account.

h. Recognized cost of goods sold in the amount of $6,400.

b. Recorded estimated bad debts in the amount of $1,400.

c. Wrote off an overdue account receivable of $1,040.

d. Converted a customer's $2,400 overdue account receivable into a note.

e. Accrued $96 of interest earned on the note (in d ).

f. Collected the accrued interest (in e ).

g. Recorded $8,000 of sales, 70% of which were on account.

h. Recognized cost of goods sold in the amount of $6,400.

Explanation

Transaction Analysis:

Transaction Analys...

Accounting: What the Numbers Mean 11th Edition by Wayne McManus,Daniel Viele,David Marshall

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255