Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Edition 2ISBN: 978-0077274993

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Edition 2ISBN: 978-0077274993 Exercise 6

Special Order

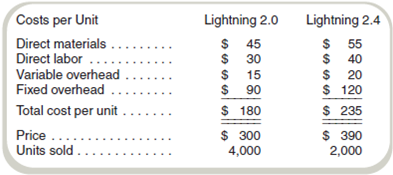

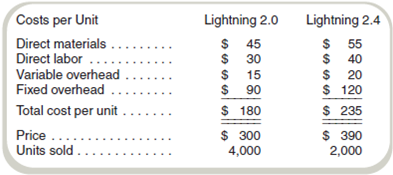

Hi-Speed Electronics manufactures low-cost, consumer-grade computers. It sells these computers to various electronics retailers to market under store brand names. It manufactures two computers, the Lightning 2.0 and the Lightning 2.4, which differ in terms of speed, included memory, and included hard drive capacity. The following information is available:

The average wage rate is $20 per hour. Variable overhead varies with the quantity of direct labor hours. The plant has a capacity of 18,000 direct labor-hours, but current production uses only 10,000 direct labor-hours.

Required

a. A nationwide discount chain has offered to buy 2,000 Lightning 2.0 computers and 2,000 Lightning 2.4 computers if the price is lowered to $200 and $250, respectively, per unit. If Hi-Speed accepts the offer, how many direct labor-hours will be required to produce the additional computers How much will the profit increase (or decrease) if Hi-Speed accepts this proposal Prices on regular sales will remain the same.

b. Suppose that the nationwide discount chain has offered instead to buy 3,000 each of the two models at $200 and $250, respectively. This customer will purchase the 3,000 units of each model only in an all-or-nothing deal. That is, Hi-Speed Electronics must provide all 3,000 units of each model or none. Hi-Speed's management has decided to fill the entire special order for both models. In view of its capacity constraints, Hi-Speed will reduce sales to regular customers as needed to fill the special order. How much will the profits change if the order is accepted Assume that the company cannot increase its production capacity to meet the extra demand.

c. Answer the question in requirement ( b ), assuming instead that the plant can work overtime. Direct labor costs for the overtime production increase to $30 per hour. Variable overhead costs for overtime production are $5 per hour more than for normal production.

Hi-Speed Electronics manufactures low-cost, consumer-grade computers. It sells these computers to various electronics retailers to market under store brand names. It manufactures two computers, the Lightning 2.0 and the Lightning 2.4, which differ in terms of speed, included memory, and included hard drive capacity. The following information is available:

The average wage rate is $20 per hour. Variable overhead varies with the quantity of direct labor hours. The plant has a capacity of 18,000 direct labor-hours, but current production uses only 10,000 direct labor-hours.

Required

a. A nationwide discount chain has offered to buy 2,000 Lightning 2.0 computers and 2,000 Lightning 2.4 computers if the price is lowered to $200 and $250, respectively, per unit. If Hi-Speed accepts the offer, how many direct labor-hours will be required to produce the additional computers How much will the profit increase (or decrease) if Hi-Speed accepts this proposal Prices on regular sales will remain the same.

b. Suppose that the nationwide discount chain has offered instead to buy 3,000 each of the two models at $200 and $250, respectively. This customer will purchase the 3,000 units of each model only in an all-or-nothing deal. That is, Hi-Speed Electronics must provide all 3,000 units of each model or none. Hi-Speed's management has decided to fill the entire special order for both models. In view of its capacity constraints, Hi-Speed will reduce sales to regular customers as needed to fill the special order. How much will the profits change if the order is accepted Assume that the company cannot increase its production capacity to meet the extra demand.

c. Answer the question in requirement ( b ), assuming instead that the plant can work overtime. Direct labor costs for the overtime production increase to $30 per hour. Variable overhead costs for overtime production are $5 per hour more than for normal production.

Explanation

(a)Direct Labor hours per hour is $20 me...

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255