Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Edition 2ISBN: 978-0077274993

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Edition 2ISBN: 978-0077274993 Exercise 28

Job Costs in a Service Company

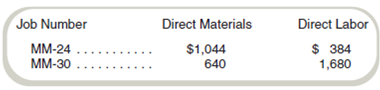

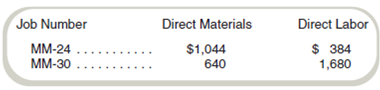

On September 1, two jobs were in process at Macon Masonry. Details of the jobs follow:

Materials Inventory on September 1 totaled $5,520, and $696 worth of materials was purchased during the month. Indirect materials of $96 were withdrawn from materials inventory. On September 1, finished goods inventory consisted of two jobs, MM-12, costing $2,352, and MM-14, with a cost of $948. Costs for both jobs were transferred to Cost of Services Billed during the month.

Also during September, Jobs MM-24 and MM-30 were completed. Completing Job MM-24 required an additional $1,360 in direct labor. The completion costs for Job MM-30 included $648 in direct materials and $4,000 in direct labor.

Macon Masonry used a total of $1,884 of direct materials (excluding the $96 indirect materials) during the period, and total direct labor costs during the month amounted to $8,160. Overhead has been estimated at 50 percent of direct labor costs, and this relation has been the same for the past few years.

Required

Compute the costs of Jobs MM-24 and MM-30 and the balances in the September 30 inventory accounts.

On September 1, two jobs were in process at Macon Masonry. Details of the jobs follow:

Materials Inventory on September 1 totaled $5,520, and $696 worth of materials was purchased during the month. Indirect materials of $96 were withdrawn from materials inventory. On September 1, finished goods inventory consisted of two jobs, MM-12, costing $2,352, and MM-14, with a cost of $948. Costs for both jobs were transferred to Cost of Services Billed during the month.

Also during September, Jobs MM-24 and MM-30 were completed. Completing Job MM-24 required an additional $1,360 in direct labor. The completion costs for Job MM-30 included $648 in direct materials and $4,000 in direct labor.

Macon Masonry used a total of $1,884 of direct materials (excluding the $96 indirect materials) during the period, and total direct labor costs during the month amounted to $8,160. Overhead has been estimated at 50 percent of direct labor costs, and this relation has been the same for the past few years.

Required

Compute the costs of Jobs MM-24 and MM-30 and the balances in the September 30 inventory accounts.

Explanation

Calculate the costs of Jobs MM-24 and MM...

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255