Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Edition 2ISBN: 978-0077274993

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Edition 2ISBN: 978-0077274993 Exercise 43

Incomplete Data: Job Costing

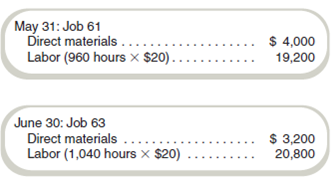

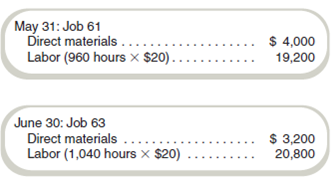

Chelsea Household Renovations (CHR) is a rapidly growing company that has not been profitable despite increases in sales. It has hired you as a consultant to find ways to improve profitability. You believe that the problem results from poor cost control and inaccurate cost estimation on jobs. The company has essentially no accounting system from which to collect data. You are able, however, to piece together the following information for June:

•Production

1. Completed Job 61.

2. Started and completed Job 62.

3. Started Job 63.

•Inventory values

1. Work-in-process inventory:

•Each job in work-in-process inventory was exactly 50 percent completed as to labor-hours; however, all direct materials necessary to do the entire job were charged to each job as soon as it was started.

•There were no direct materials inventories or finished goods inventories at either May 31 or June 30.

•Actual overhead was $40,000.

•Cost of goods sold (before adjustment for over- or underapplied overhead):

•Overhead was applied to jobs using a predetermined rate per labor dollar that has been used since the company began operations.

•All direct materials were purchased for cash and charged directly to Work-in-Process Inventory when purchased. Direct materials purchased in June amounted to $9,200.

•Direct labor costs charged to jobs in June were $64,000. All labor costs were the same per hour for all laborers for June.

Required

Write a report to management to show:

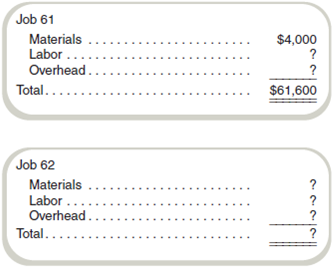

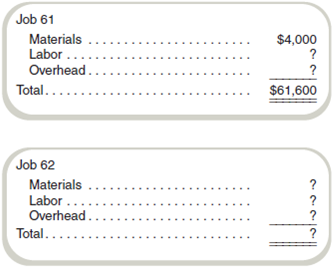

a. The cost elements (material, labor, and overhead) of cost of goods sold before adjustment for over- or underapplied overhead for each job sold.

b. The value of each cost element (material, labor, and overhead) for each job in work-in-process inventory at June 30.

c. Over- or underapplied overhead for June.

Chelsea Household Renovations (CHR) is a rapidly growing company that has not been profitable despite increases in sales. It has hired you as a consultant to find ways to improve profitability. You believe that the problem results from poor cost control and inaccurate cost estimation on jobs. The company has essentially no accounting system from which to collect data. You are able, however, to piece together the following information for June:

•Production

1. Completed Job 61.

2. Started and completed Job 62.

3. Started Job 63.

•Inventory values

1. Work-in-process inventory:

•Each job in work-in-process inventory was exactly 50 percent completed as to labor-hours; however, all direct materials necessary to do the entire job were charged to each job as soon as it was started.

•There were no direct materials inventories or finished goods inventories at either May 31 or June 30.

•Actual overhead was $40,000.

•Cost of goods sold (before adjustment for over- or underapplied overhead):

•Overhead was applied to jobs using a predetermined rate per labor dollar that has been used since the company began operations.

•All direct materials were purchased for cash and charged directly to Work-in-Process Inventory when purchased. Direct materials purchased in June amounted to $9,200.

•Direct labor costs charged to jobs in June were $64,000. All labor costs were the same per hour for all laborers for June.

Required

Write a report to management to show:

a. The cost elements (material, labor, and overhead) of cost of goods sold before adjustment for over- or underapplied overhead for each job sold.

b. The value of each cost element (material, labor, and overhead) for each job in work-in-process inventory at June 30.

c. Over- or underapplied overhead for June.

Explanation

The beginning and ending balance of the ...

Fundamentals of Cost Accounting 2nd Edition by William Lanen, Carolyn Wells, Michael Maher

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255