Contemporary Engineering Economics 6th Edition by Chan Park

Edition 6ISBN: 978-0134162690

Contemporary Engineering Economics 6th Edition by Chan Park

Edition 6ISBN: 978-0134162690 Exercise 2

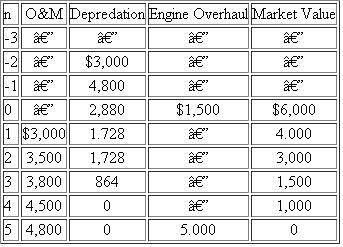

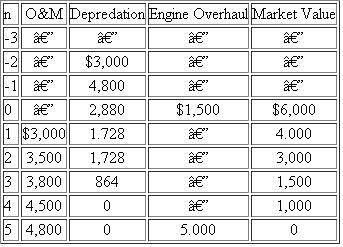

The Columbus Electronics Company is considering replacing a 1,000-pound-capacity forklift truck that was purchased three years ago at a cost of $15,000. The diesel-operated forklift was originally expected to have a useful life of eight years and a zero estimated salvage value at the end of that period. The truck has not been dependable and is frequently out of service while awaiting repairs. The maintenance expenses of the truck have been rising steadily and currently amount to about $3,000 per year The truck could be sold for $6,000. If retained, the truck will require an immediate $1,500 overhaul to keep it in operating condition. This overhaul will neither extend the originally estimated service life nor increase the value of the truck. The updated annual operating costs, engine overhaul cost, and market values over the next five years are estimated as given in Table.

A drastic increase in operating costs during the fifth year is expected due to another overhaul, which will again be required to keep the truck in operating condition. The firm's MARR is 15%.

(a) If the truck is to be sold now, what will be its sunk cost?

(b) What is the opportunity cost of not replacing the truck now?

(c) What is the equivalent annual cost of owning and operating the truck for two more years?

(d) What is the equivalent annual cost of owning and operating the truck for five years?

Table

A drastic increase in operating costs during the fifth year is expected due to another overhaul, which will again be required to keep the truck in operating condition. The firm's MARR is 15%.

(a) If the truck is to be sold now, what will be its sunk cost?

(b) What is the opportunity cost of not replacing the truck now?

(c) What is the equivalent annual cost of owning and operating the truck for two more years?

(d) What is the equivalent annual cost of owning and operating the truck for five years?

Table

Explanation

a)

The first part of the problem that on...

Contemporary Engineering Economics 6th Edition by Chan Park

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255