Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

Edition 6ISBN: 9780071283700

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

Edition 6ISBN: 9780071283700 Exercise 22

Outdoor Lites is a small division of American Lighting, accounting for less than 5 percent of sales and profits of the parent. Outdoor manufactures a variety of residential lighting systems. For the last 10 years Outdoor has had low profits. Two years ago American brought in new senior management at Outdoor to turn things around. Despite a poor profit performance in its first year, which was attributable to the previous managers, under the new management, Outdoor produced impressive profit increases in the second year.

American Lighting has the following accounting policies for all its subsidiaries: FIFO inventory accounting and all budget variances including over/underabsorbed overhead are written off to cost of goods sold if the variance is less than 15 percent of the budget; otherwise they are prorated between cost of goods sold and inventories.

Outdoor Lites allocates overhead to products using direct labor hours. A flexible budget is used to forecast overhead at the beginning of the year. Because of variability in residential housing starts, it is difficult to forecast overhead accurately.

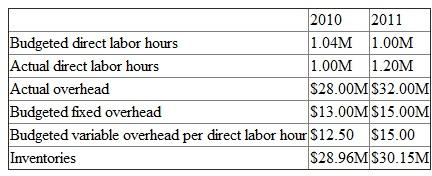

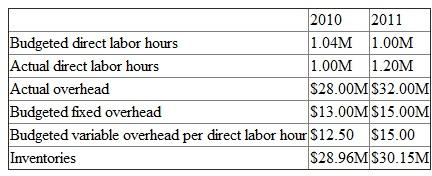

The following data summarize operations at Outdoor Lites for the last two years (M = millions):

Required:

Required:

a. Calculate the amount of over/underabsorbed overhead in 2010 and 2011.

b. Pretax income increased from $10 to $20 million between 2010 and 2011 (inclusive of all budget variances). Write a short memo evaluating the performance of the new senior management of Outdoor Lites.

American Lighting has the following accounting policies for all its subsidiaries: FIFO inventory accounting and all budget variances including over/underabsorbed overhead are written off to cost of goods sold if the variance is less than 15 percent of the budget; otherwise they are prorated between cost of goods sold and inventories.

Outdoor Lites allocates overhead to products using direct labor hours. A flexible budget is used to forecast overhead at the beginning of the year. Because of variability in residential housing starts, it is difficult to forecast overhead accurately.

The following data summarize operations at Outdoor Lites for the last two years (M = millions):

Required:

Required: a. Calculate the amount of over/underabsorbed overhead in 2010 and 2011.

b. Pretax income increased from $10 to $20 million between 2010 and 2011 (inclusive of all budget variances). Write a short memo evaluating the performance of the new senior management of Outdoor Lites.

Explanation

Overheads are allocated to products base...

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255