Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

Edition 6ISBN: 9780071283700

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

Edition 6ISBN: 9780071283700 Exercise 1

Olat Corporation

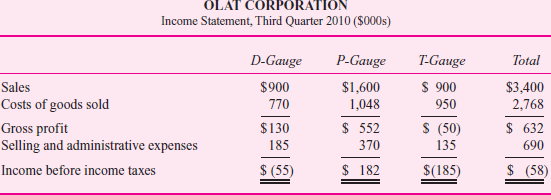

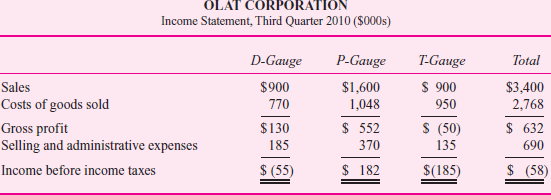

Olat Corporation produces three gauges. These gauges measure density, permeability, and thickness and are known as D-gauges, P-gauges, and T-gauges, respectively. For many years the company was profitable and operated at capacity. However, in the last two years prices on all gauges were reduced and selling expenses increased to meet competition and keep the plant operating at full capacity. Third-quarter results in this table are representative of recent experience:

Mel Carlo, president of Olat, is very concerned about the results of the pricing, selling, and production policies. After reviewing the third-quarter results he asked his management staff to consider a course of action that includes the following three suggestions:

1. Discontinue the T-gauge line immediately unless the problems with the gauge can be identified and resolved.

2. Increase quarterly sales promotion by $100,000 on the P-gauge product line to increase sales volume 15 percent.

3. Cut production on the D-gauge line by 50 percent, a quantity sufficient to meet the demand of customers who purchase P-gauges. In addition, cut the traceable advertising and promotion for this line to $20,000 each quarter.

George Sperry, controller, suggested a more careful study of the financial relations to determine the possible effect on the company's operating results of the president's proposed course of action. The president agreed, and JoAnn Brower, assistant controller, was assigned to prepare an analysis. To do so, she gathered the following information:

• All three gauges are manufactured with common equipment and facilities.

• The quarterly general, selling, and administrative expenses of $170,000 are allocated to the three gauge lines in proportion to their dollar sales volumes.

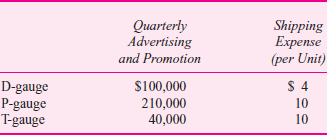

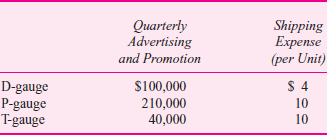

• Special selling expenses (primarily advertising, promotion, and shipping) are incurred for each gauge as follows:

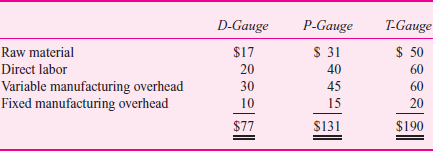

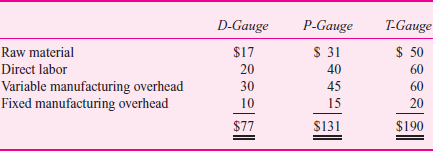

The unit manufacturing costs for the three products are as follows:

The unit sales prices for the three products are as follows:

The company is manufacturing at capacity and is selling all the gauges it produces.

Required:

a. JoAnn Brower has suggested that Olat Corporation's product line income statement as presented for the third quarter of 2010 is not suitable for analyzing Mel Carlo's proposals.

(i) Explain why the product line income statement as presented is not suitable for analysis and decision making.

(ii) Describe an alternative income statement format more suitable for analysis and decision making. Explain why it is better.

b. Use the operating data presented for Olat Corp. and assume that Mel Carlo's proposed course of action was implemented at the beginning of the third quarter of 2010. Evaluate the president's proposed course of action by specifically responding to the following points:

(i) Are each of the three suggestions cost effective Your discussion should be supported by a differential analysis that shows the net impact on income before taxes for each of the three suggestions.

(ii) Was the president correct in eliminating the T-gauge line Explain your answer.

(iii) Was the president correct in promoting the P-gauge line rather than the D-gauge line Explain your answer.

(iv) Does the proposed course of action make effective use of Olat's capacity Explain your answer.

c. Are there any nonquantitative factors that Olat should consider before dropping the T-gauge line

Olat Corporation produces three gauges. These gauges measure density, permeability, and thickness and are known as D-gauges, P-gauges, and T-gauges, respectively. For many years the company was profitable and operated at capacity. However, in the last two years prices on all gauges were reduced and selling expenses increased to meet competition and keep the plant operating at full capacity. Third-quarter results in this table are representative of recent experience:

Mel Carlo, president of Olat, is very concerned about the results of the pricing, selling, and production policies. After reviewing the third-quarter results he asked his management staff to consider a course of action that includes the following three suggestions:

1. Discontinue the T-gauge line immediately unless the problems with the gauge can be identified and resolved.

2. Increase quarterly sales promotion by $100,000 on the P-gauge product line to increase sales volume 15 percent.

3. Cut production on the D-gauge line by 50 percent, a quantity sufficient to meet the demand of customers who purchase P-gauges. In addition, cut the traceable advertising and promotion for this line to $20,000 each quarter.

George Sperry, controller, suggested a more careful study of the financial relations to determine the possible effect on the company's operating results of the president's proposed course of action. The president agreed, and JoAnn Brower, assistant controller, was assigned to prepare an analysis. To do so, she gathered the following information:

• All three gauges are manufactured with common equipment and facilities.

• The quarterly general, selling, and administrative expenses of $170,000 are allocated to the three gauge lines in proportion to their dollar sales volumes.

• Special selling expenses (primarily advertising, promotion, and shipping) are incurred for each gauge as follows:

The unit manufacturing costs for the three products are as follows:

The unit sales prices for the three products are as follows:

The company is manufacturing at capacity and is selling all the gauges it produces.

Required:

a. JoAnn Brower has suggested that Olat Corporation's product line income statement as presented for the third quarter of 2010 is not suitable for analyzing Mel Carlo's proposals.

(i) Explain why the product line income statement as presented is not suitable for analysis and decision making.

(ii) Describe an alternative income statement format more suitable for analysis and decision making. Explain why it is better.

b. Use the operating data presented for Olat Corp. and assume that Mel Carlo's proposed course of action was implemented at the beginning of the third quarter of 2010. Evaluate the president's proposed course of action by specifically responding to the following points:

(i) Are each of the three suggestions cost effective Your discussion should be supported by a differential analysis that shows the net impact on income before taxes for each of the three suggestions.

(ii) Was the president correct in eliminating the T-gauge line Explain your answer.

(iii) Was the president correct in promoting the P-gauge line rather than the D-gauge line Explain your answer.

(iv) Does the proposed course of action make effective use of Olat's capacity Explain your answer.

c. Are there any nonquantitative factors that Olat should consider before dropping the T-gauge line

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255