Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

Edition 6ISBN: 9780071283700

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

Edition 6ISBN: 9780071283700 Exercise 9

Roderiques manufactures five products (P1, P2, P3, M1, and M2) in two product lines (P product line and M product line). The firm uses activity-based costing to allocate the four activity centers comprising manufacturing overhead to the five products. It assigns batch-level costs using number of batches, product-level costs using number of product lines, part-level costs using number of parts in each product, and facility-level costs using direct labor dollars.

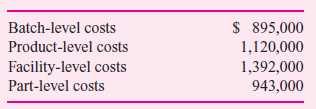

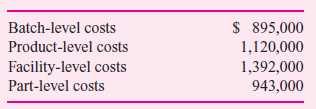

The following table summarizes the total costs in each of the four activity centers:

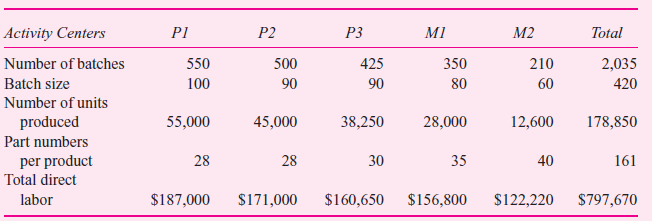

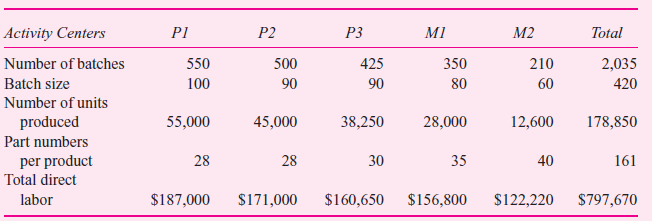

The following table summarizes the operating data for each product:

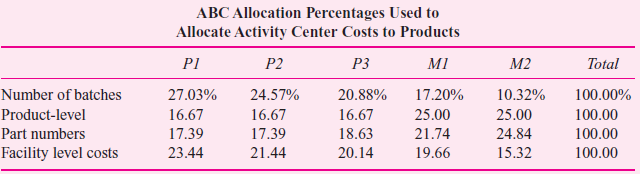

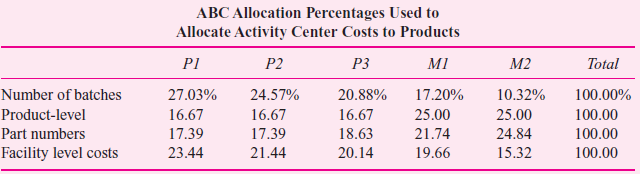

Based on the data in the preceding table, the firm calculates the following percentages used by the ABC system to allocate costs to the five products. Note that product-line costs are first allocated to the two product lines evenly and then assigned to each product within the product line based on units.

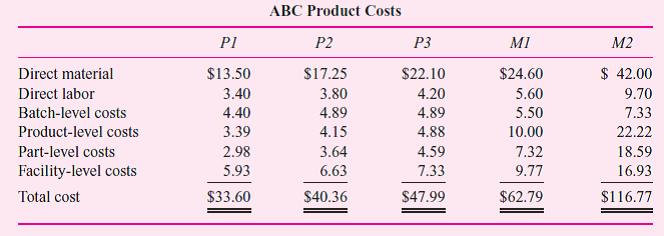

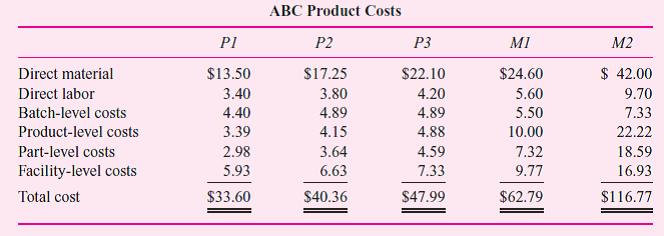

The final table presents the ABC product costs based on the preceding data.

Senior management at Roderiques is considering converting back to a more traditional absorption costing system. In particular, they want to allocate batch-level costs and part-level costs using direct material dollars and product-level costs and facility-level costs using direct labor dollars.

Required:

a. Calculate product costs per unit for each of the five products, where batch-level and part-level costs are allocated based on total direct material dollars, and product- level and facility-level costs are allocated based on total direct labor dollars.

b. Describe how the product costs per unit change relative to those computed using activity-based costing. What is causing product costs to change in the particular ways that they do

c. Offer some plausible reasons why management might want to abandon ABC and revert to a more traditional product-costing methodology.

The following table summarizes the total costs in each of the four activity centers:

The following table summarizes the operating data for each product:

Based on the data in the preceding table, the firm calculates the following percentages used by the ABC system to allocate costs to the five products. Note that product-line costs are first allocated to the two product lines evenly and then assigned to each product within the product line based on units.

The final table presents the ABC product costs based on the preceding data.

Senior management at Roderiques is considering converting back to a more traditional absorption costing system. In particular, they want to allocate batch-level costs and part-level costs using direct material dollars and product-level costs and facility-level costs using direct labor dollars.

Required:

a. Calculate product costs per unit for each of the five products, where batch-level and part-level costs are allocated based on total direct material dollars, and product- level and facility-level costs are allocated based on total direct labor dollars.

b. Describe how the product costs per unit change relative to those computed using activity-based costing. What is causing product costs to change in the particular ways that they do

c. Offer some plausible reasons why management might want to abandon ABC and revert to a more traditional product-costing methodology.

Explanation

a. Product costs where batch-level and f...

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255