Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

Edition 6ISBN: 9780071283700

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

Edition 6ISBN: 9780071283700 Exercise 10

Inorganics, Inc.

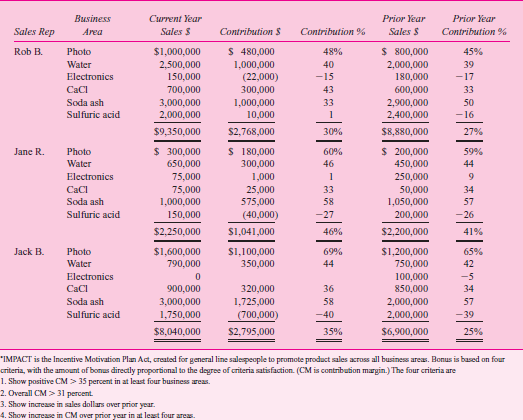

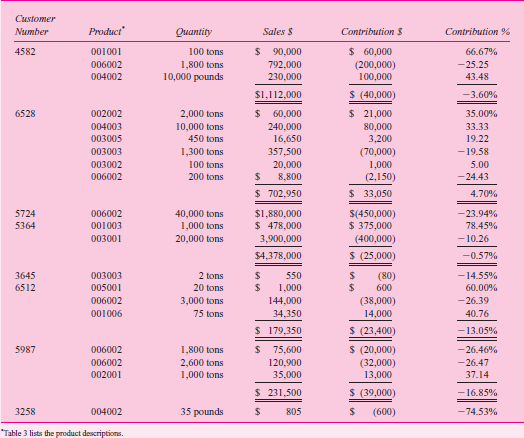

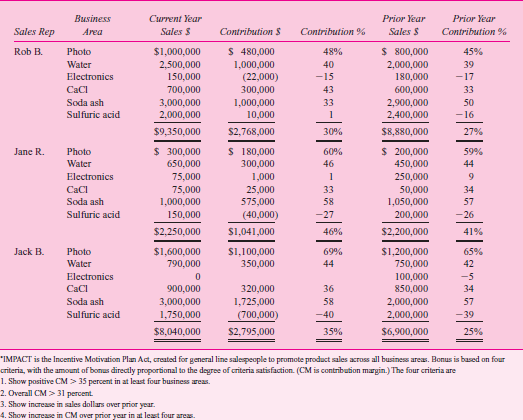

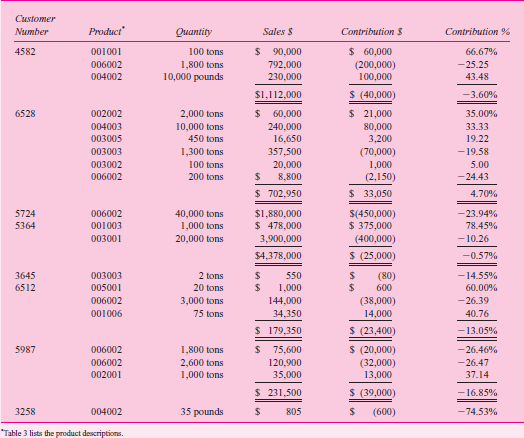

At the monthly managers' meeting, the vice president of marketing, Fred Rooks, pointed out that based on the new IMPACT (Incentive Motivation Plan Act), only 4 of the 19 general line salespeople qualified for the annual bonus. (Table 1 explains IMPACT and shows sample salesperson performance.) He believed that these bonus results were too low since 12 salespeople had received bonuses the previous year. Furthermore, he was concerned over the increasing number of customer and distributor accounts with low or negative contribution margins. (Table 2 gives sample accounts with low contribution margins.) He explained, "The state of the economy is uncertain. A recession would force us to tighten our credit policy to control the accounts receivable outstanding. This might mean dropping marginal accounts. These low contribution margins are unprofitable for us."

T ABLE 1 Sample of Salesperson Performance for Current Year Based on IMPACT *

Company background

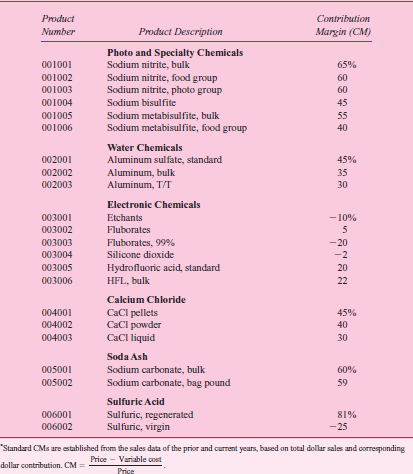

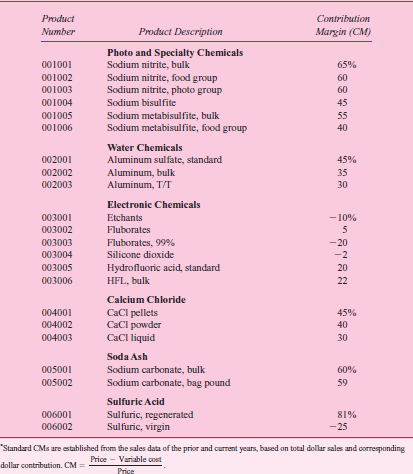

Inorganics is a closely held company that manufactures and distributes industrial and specialty chemicals. The company requires a contribution margin of 30 percent across all products and business areas to obtain a required rate of return. (Table 3 lists the standard contribution margins.) Inorganics's management is evaluated on its ability to meet the corporatewide profit objectives. Among its portfolio of chemical businesses, Inorganics's revenues are derived from the soda ash unit, the water chemicals division, the electronic chemicals unit, photo and specialty chemicals, calcium chloride, and the sulfuric acid business. These chemicals are manufactured at various plant locations across North America. In addition, Inorganics distributes imported methanol and other chemicals purchased from outside manufacturers.

T ABLE 2 Sample Customer Accounts with Low Contribution Margins (Year to Date)

T ABLE 3 Standard Contribution Margins *

Electronic chemicals division

The electronic chemicals division is a low-volume order business. The division has not been profitable for 10 years. The firm has not made any capital expenditures in this division and is seeking to divest this unit. However, management has been unable to find a buyer. Shutdown of this unit would require cleanup to meet EPA regulations. The cost of this cleanup is estimated to be $50 to $100 million. Inorganics's management does not feel it can afford the costs associated with this cleanup and hence has not shut down the division. Electronic Chemicals is the only unprofitable division of Inorganics.

Sulfuric acid division

The sulfuric acid business is specific to the oil and petrochemical industry. Pipelines from customer refineries bring in spent acid for regeneration. This is a very profitable core activity of the sulfuric acid business. This business is a service provided to the oil refineries to refurbish spent acid from the refinery alkylation or detergent manufacturing processes. If these customers choose to replace their used acid with a new supply, they bear a significant cost in disposing their spent acid to meet EPA regulations.

The regeneration process of the recovered spent acid produces one ton of the regenerated acid (which is piped back to the customer refinery) and two tons of virgin acid for every one ton of spent acid input. There is a negligible cost attached to further process this virgin acid to meet marketable standards. The price for the regenerated acid is set through negotiations with the customer. The average price for the regenerated acid is $260 per ton. The market for the virgin acid is highly competitive and Inorganics is a price taker for this commodity. The average price is $40 per ton for the virgin acid. If Inorganics chooses not to compete in the virgin acid market, it bears a cost of $20 per ton to dispose of this acid per EPA regulations. Both products are costed using fully absorbed costing. The comptroller mentioned that all costs were allocated equally to the three-ton output to reflect the costs of product sold. The cost of goods sold for the sulfuric acid business has been averaged out equally over the total production output.

Marketing manager Ray Bash, whose primary responsibility is to manage the virgin acid business, complained, "Boy, are they unfair! They give you a low contribution product and then evaluate you on profitability. They don't respect the efforts and results that I have obtained in increasing our market share."

Required:

Evaluate the issues raised at the managers' meeting and make recommendations. The issues raised include whether unprofitable customer accounts should be discontinued and how sales performance should be evaluated.

At the monthly managers' meeting, the vice president of marketing, Fred Rooks, pointed out that based on the new IMPACT (Incentive Motivation Plan Act), only 4 of the 19 general line salespeople qualified for the annual bonus. (Table 1 explains IMPACT and shows sample salesperson performance.) He believed that these bonus results were too low since 12 salespeople had received bonuses the previous year. Furthermore, he was concerned over the increasing number of customer and distributor accounts with low or negative contribution margins. (Table 2 gives sample accounts with low contribution margins.) He explained, "The state of the economy is uncertain. A recession would force us to tighten our credit policy to control the accounts receivable outstanding. This might mean dropping marginal accounts. These low contribution margins are unprofitable for us."

T ABLE 1 Sample of Salesperson Performance for Current Year Based on IMPACT *

Company background

Inorganics is a closely held company that manufactures and distributes industrial and specialty chemicals. The company requires a contribution margin of 30 percent across all products and business areas to obtain a required rate of return. (Table 3 lists the standard contribution margins.) Inorganics's management is evaluated on its ability to meet the corporatewide profit objectives. Among its portfolio of chemical businesses, Inorganics's revenues are derived from the soda ash unit, the water chemicals division, the electronic chemicals unit, photo and specialty chemicals, calcium chloride, and the sulfuric acid business. These chemicals are manufactured at various plant locations across North America. In addition, Inorganics distributes imported methanol and other chemicals purchased from outside manufacturers.

T ABLE 2 Sample Customer Accounts with Low Contribution Margins (Year to Date)

T ABLE 3 Standard Contribution Margins *

Electronic chemicals division

The electronic chemicals division is a low-volume order business. The division has not been profitable for 10 years. The firm has not made any capital expenditures in this division and is seeking to divest this unit. However, management has been unable to find a buyer. Shutdown of this unit would require cleanup to meet EPA regulations. The cost of this cleanup is estimated to be $50 to $100 million. Inorganics's management does not feel it can afford the costs associated with this cleanup and hence has not shut down the division. Electronic Chemicals is the only unprofitable division of Inorganics.

Sulfuric acid division

The sulfuric acid business is specific to the oil and petrochemical industry. Pipelines from customer refineries bring in spent acid for regeneration. This is a very profitable core activity of the sulfuric acid business. This business is a service provided to the oil refineries to refurbish spent acid from the refinery alkylation or detergent manufacturing processes. If these customers choose to replace their used acid with a new supply, they bear a significant cost in disposing their spent acid to meet EPA regulations.

The regeneration process of the recovered spent acid produces one ton of the regenerated acid (which is piped back to the customer refinery) and two tons of virgin acid for every one ton of spent acid input. There is a negligible cost attached to further process this virgin acid to meet marketable standards. The price for the regenerated acid is set through negotiations with the customer. The average price for the regenerated acid is $260 per ton. The market for the virgin acid is highly competitive and Inorganics is a price taker for this commodity. The average price is $40 per ton for the virgin acid. If Inorganics chooses not to compete in the virgin acid market, it bears a cost of $20 per ton to dispose of this acid per EPA regulations. Both products are costed using fully absorbed costing. The comptroller mentioned that all costs were allocated equally to the three-ton output to reflect the costs of product sold. The cost of goods sold for the sulfuric acid business has been averaged out equally over the total production output.

Marketing manager Ray Bash, whose primary responsibility is to manage the virgin acid business, complained, "Boy, are they unfair! They give you a low contribution product and then evaluate you on profitability. They don't respect the efforts and results that I have obtained in increasing our market share."

Required:

Evaluate the issues raised at the managers' meeting and make recommendations. The issues raised include whether unprofitable customer accounts should be discontinued and how sales performance should be evaluated.

Explanation

This question doesn’t have an expert verified answer yet, let Quizplus AI Copilot help.

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255