Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

Edition 6ISBN: 9780071283700

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

Edition 6ISBN: 9780071283700 Exercise 7

Home Lending Inc. (HLI) is a mortgage application service company. It is a subsidiary of Relocation Realty, a large real estate sales firm. Real estate agents working for Relocation Realty refer their clients to HLI to arrange financing. Instead of contacting several banks to compare mortgage rates, home buyers use HLI as an intermediary. HLI maintains a current list of all of the various mortgage terms at all area banks (fixed and adjustable rates, terms, balloon payments, points, etc.). Home buyers in one place can then select the mortgage parameters that best fit their situation. Because all banks use a common mortgage application form, HLI can fill out and file the necessary application for its client. Banks and HLI charge one point (1 percent of the requested loan amount) for filing the application if it is approved. (In the rare event that a bank denies an application, the loan applicant is not charged any fee.) Consumers are indifferent between filing an application directly with the bank versus using HLI.

HLI employs mortgage processors who meet with the home buyers, go over the various loan options, file the applications, and represent the borrower when the loan is consummated. Each processor can file a maximum of 120 mortgages per year. HLI owns and maintains a mainframe computer system that automates the loan application process. In addition to the mortgage processors, HLI employs secretaries who function as receptionists, computer data entry clerks, and office supply managers. The president of HLI, Linda Jeter, oversees the office, hires (and fires) office staff, and helps with difficult loan applications. She reports to the owner of Relocation Realty.

The housing market is in a recession. Two years ago HLI processed 580 mortgages with an average mortgage of $80,000 and employed five processors and two secretaries. This year Jeter projects only 280 mortgage filings with an average mortgage of $70,000. She laid off two processors and a secretary last year.

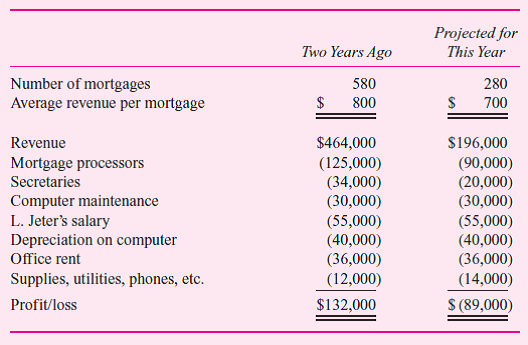

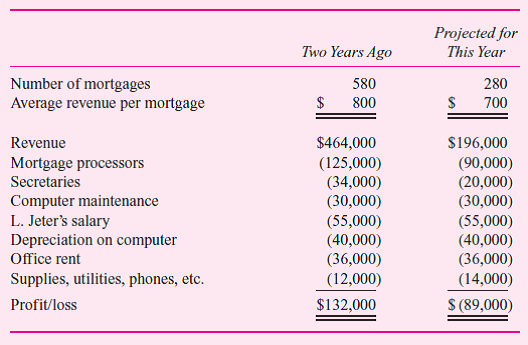

The following data summarize operations two years ago and the projections for this year:

HLI has noncancelable five-year contracts for office rent and computer maintenance, with one more year to run on each contract. The computer system and office equipment have no salvage values. Jeter has been told to cut the losses or else Relocation Realty will close the subsidiary. She is considering two possibilities: further layoffs of mortgage processors or cutting the price charged for mortgage processing to 3 /4 of 1 percent. She thinks such a price cut will not be met immediately by the competition and in the meantime will increase the quantity demanded by 30 percent. Ignoring taxes, evaluate the various proposals and recommend a course of action for Jeter. Justify your recommendation with a clearly presented financial analysis.

HLI employs mortgage processors who meet with the home buyers, go over the various loan options, file the applications, and represent the borrower when the loan is consummated. Each processor can file a maximum of 120 mortgages per year. HLI owns and maintains a mainframe computer system that automates the loan application process. In addition to the mortgage processors, HLI employs secretaries who function as receptionists, computer data entry clerks, and office supply managers. The president of HLI, Linda Jeter, oversees the office, hires (and fires) office staff, and helps with difficult loan applications. She reports to the owner of Relocation Realty.

The housing market is in a recession. Two years ago HLI processed 580 mortgages with an average mortgage of $80,000 and employed five processors and two secretaries. This year Jeter projects only 280 mortgage filings with an average mortgage of $70,000. She laid off two processors and a secretary last year.

The following data summarize operations two years ago and the projections for this year:

HLI has noncancelable five-year contracts for office rent and computer maintenance, with one more year to run on each contract. The computer system and office equipment have no salvage values. Jeter has been told to cut the losses or else Relocation Realty will close the subsidiary. She is considering two possibilities: further layoffs of mortgage processors or cutting the price charged for mortgage processing to 3 /4 of 1 percent. She thinks such a price cut will not be met immediately by the competition and in the meantime will increase the quantity demanded by 30 percent. Ignoring taxes, evaluate the various proposals and recommend a course of action for Jeter. Justify your recommendation with a clearly presented financial analysis.

Explanation

The analysis should focus on net cash fl...

Accounting for Decision Making and Control 6th Edition by Jerold Zimmerman

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255