Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 43

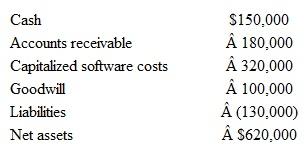

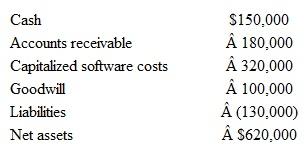

On June 1, Cline Co. paid $800,000 cash for all of the issued and outstanding common stock of Renn Corp. The carrying values for Renn's assets and liabilities on June 1 follow:

On June 1, Renn's accounts receivable had a fair value of $140,000. Additionally, Renn's in-process research and development was estimated to have a fair value of $200,000. All other items were stated at their fair values. On Cline's June 1 consolidated balance sheet, how much is reported for goodwill

a. $320,000.

b. $120,000.

c. $80,000.

d. $20,000.

On June 1, Renn's accounts receivable had a fair value of $140,000. Additionally, Renn's in-process research and development was estimated to have a fair value of $200,000. All other items were stated at their fair values. On Cline's June 1 consolidated balance sheet, how much is reported for goodwill

a. $320,000.

b. $120,000.

c. $80,000.

d. $20,000.

Explanation

The answer to this multiple choice quest...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255