Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 43

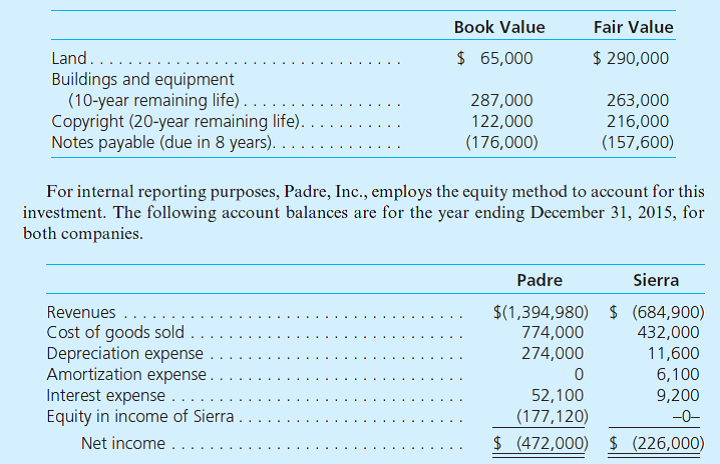

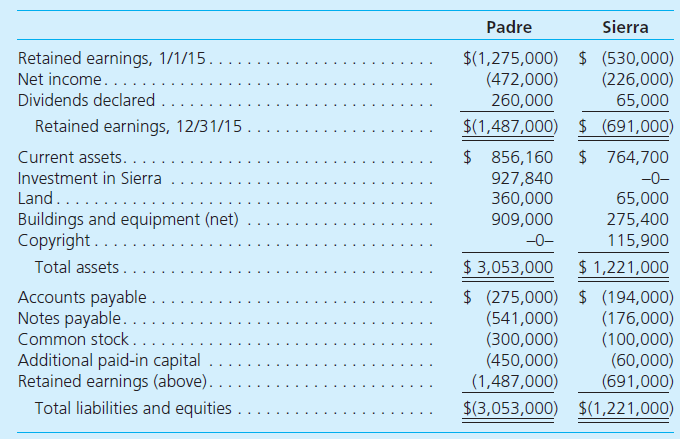

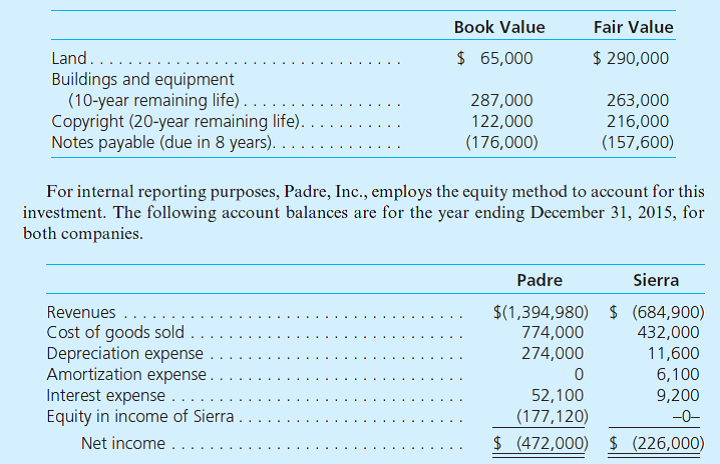

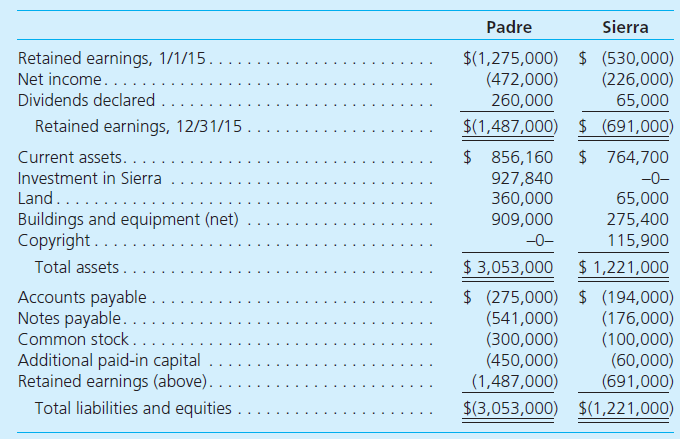

Padre, Inc., buys 80 percent of the outstanding common stock of Sierra Corporation on January 1, 2015, for $802,720 cash. At the acquisition date, Sierra's total fair value, including the non-controlling interest, was assessed at $1,003,400 although Sierra's book value was only $690,000. Also, several individual items on Sierra's financial records had fair values that differed from their book values as follows:

At year-end, there were no intra-entity receivables or payables.

Prepare a worksheet to consolidate the financial statements of these two companies.

At year-end, there were no intra-entity receivables or payables.

Prepare a worksheet to consolidate the financial statements of these two companies.

Explanation

On 1 st January 2014 P Company acquired ...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255