Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 56

On January 1, 2013, Pride Co. purchased 90 percent of the outstanding voting shares of Star Inc. for $540,000 cash. The acquisition-date fair value of the noncontrolling interest was $60,000. At January 1, 2013, Star's net assets had a total carrying amount of $420,000. Equipment (8-year remaining life) was undervalued on Star's financial records by $80,000. Any remaining excess fair value over book value was attributed to a customer list developed by Star (4-year remaining life), but not recorded on its books. Star recorded income of $70,000 in 2013 and $80,000 in 2014. Each year since the acquisition, Star has declared a $20,000 dividend. At January 1, 2015, Pride's retained earnings show a $250,000 balance.

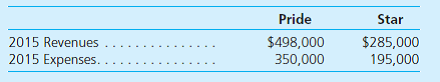

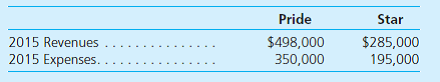

Selected account balances for the two companies from their separate operations were as follows:

What is consolidated net income for 2015

A) $194,000.

B) $197,500.

C) $203,000.

D) $238,000.

Selected account balances for the two companies from their separate operations were as follows:

What is consolidated net income for 2015

A) $194,000.

B) $197,500.

C) $203,000.

D) $238,000.

Explanation

A consolidation is a situation where, a ...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255