Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 27

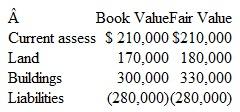

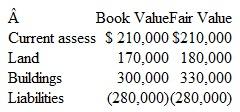

Parker, Inc.. acquires 70 percent of Sawyer Company for $420,000. The remaining.30 percent of Sawyer's outstanding shares continue to trade at a collective value of $174,000. On the acquisition date, Sawyer has the following accounts:

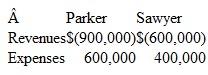

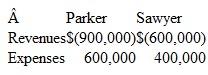

The buildings have a 10-year life. In addition, Sawyer holds a patent worth $140,000 that has a five-year life but is not recorded on its financial records. At the end of the year, the two companies report the following balances:

a. Assume that the acquisition took place on January 1. What figures would appear in a consolidated income statement for this year

b. Assume that the acquisition took place on April 1. Sawyer's revenues and expenses occurred uniformly throughout the year. What amounts would appear in a consolidated income statement for this year

The buildings have a 10-year life. In addition, Sawyer holds a patent worth $140,000 that has a five-year life but is not recorded on its financial records. At the end of the year, the two companies report the following balances:

a. Assume that the acquisition took place on January 1. What figures would appear in a consolidated income statement for this year

b. Assume that the acquisition took place on April 1. Sawyer's revenues and expenses occurred uniformly throughout the year. What amounts would appear in a consolidated income statement for this year

Explanation

Consolidated income statement is the fin...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255