Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 31

On January 1, Beckman, Inc., acquires 60 percent of the outstanding stock of Calvin for $36,000. Calvin (Co. has one recorded asset, a specialized production machine with a book value of $10,000 and no liabilities. The fair value of the machine is $50,000, and the remaining useful life is estimated to be 10 years. Any remaining excess fair value is attributable to an unrecorded process trade secret with an estimated future life of 4 years. Calvin's total acquisition-date fair value is $60,000.

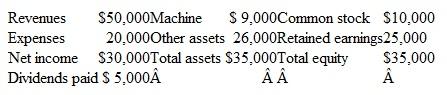

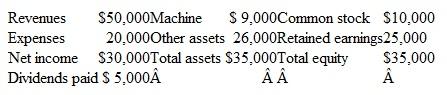

At the end of the year, Calvin reports the following in its financial statements:

Determine the amounts that Beckman should report in its year-end consolidated financial statements for noncontrolling interest in subsidiary income, total noncontrolling interest, Calvin's machine (net of accumulated depreciation), and the process trade secret.

At the end of the year, Calvin reports the following in its financial statements:

Determine the amounts that Beckman should report in its year-end consolidated financial statements for noncontrolling interest in subsidiary income, total noncontrolling interest, Calvin's machine (net of accumulated depreciation), and the process trade secret.

Explanation

Non-Controlling interest: Ownership stak...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255