Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 34

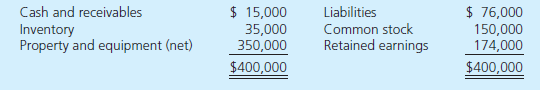

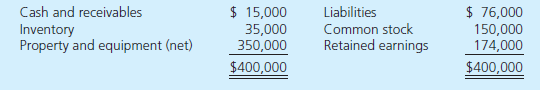

On January 1, 2013, Parflex Corporation exchanged $344,000 cash for 90 percent of Eagle Corporation's outstanding voting stock. Eagle's acquisition date balance sheet follows:

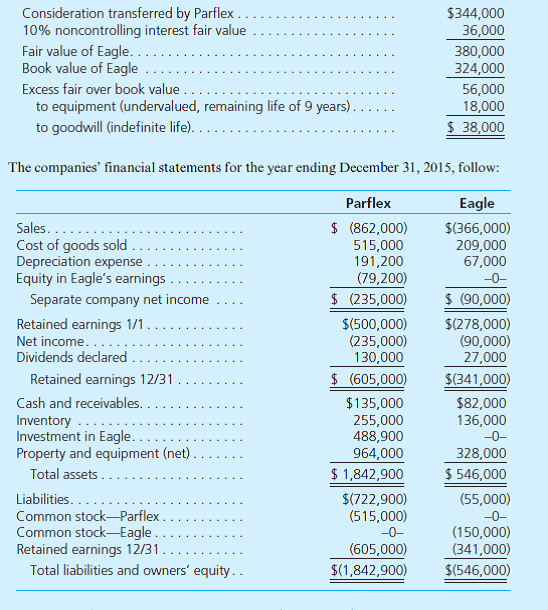

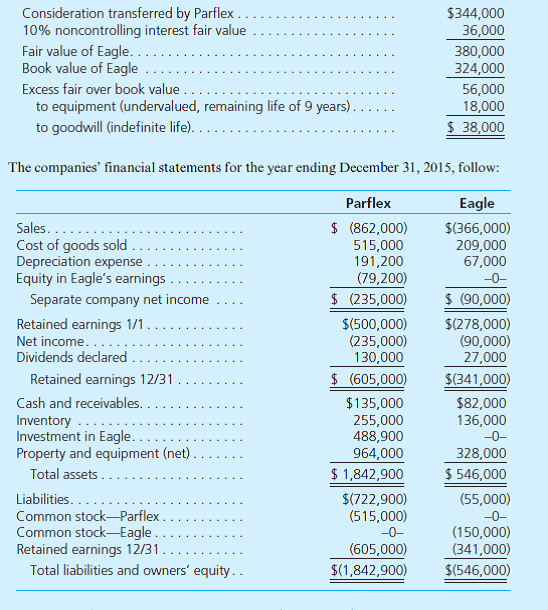

On January 1, 2013, Parflex prepared the following fair-value allocation schedule:

At year-end, there were no intra-entity receivables or payables.

a. Compute the goodwill allocation to the controlling and noncontrolling interest.

b. Show how Parflex determined its "Investment in Eagle" account balance.

c. Determine the amounts that should appear on Parflex's December 31, 2015, consolidated statement of financial position and its 2015 consolidated income statement.

On January 1, 2013, Parflex prepared the following fair-value allocation schedule:

At year-end, there were no intra-entity receivables or payables.

a. Compute the goodwill allocation to the controlling and noncontrolling interest.

b. Show how Parflex determined its "Investment in Eagle" account balance.

c. Determine the amounts that should appear on Parflex's December 31, 2015, consolidated statement of financial position and its 2015 consolidated income statement.

Explanation

a.

Compute the goodwill allocation to t...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255