Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 4

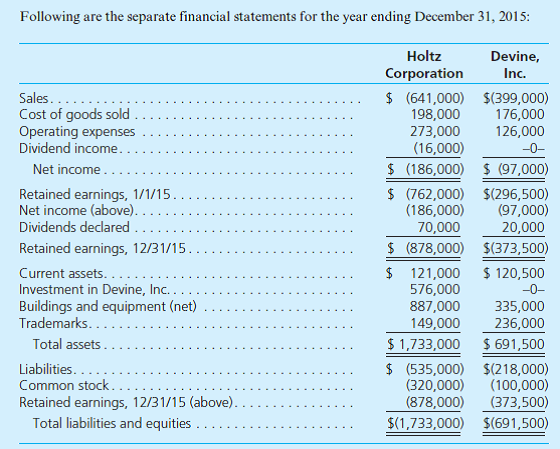

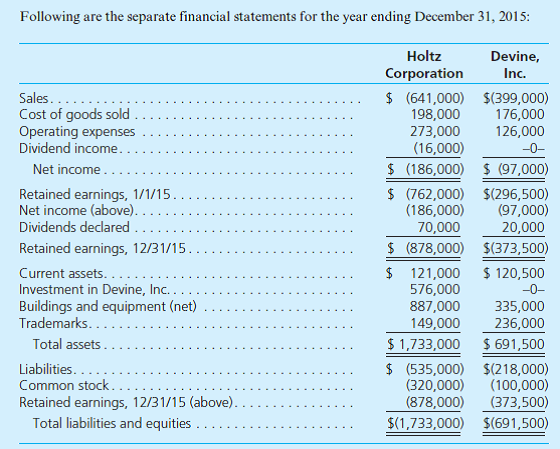

The Holtz Corporation acquired 80 percent of the 100,000 outstanding voting shares of Devine, Inc., for $7.20 per share on January 1, 2014. The remaining 20 percent of Devine's shares also traded actively at $7.20 per share before and after Holtz's acquisition. An appraisal made on that date determined that all book values appropriately reflected the fair values of Devine's underlying accounts except that a building with a 5-year future life was undervalued by $85,500 and a fully amortized trademark with an estimated 10-year remaining life had a $64,000 fair value. At the acquisition date, Devine reported common stock of $100,000 and a retained earnings balance of $226,500.

At year-end, there were no intra-entity receivables or payables.

a. Prepare a worksheet to consolidate these two companies as of December 31, 2015.

b. Prepare a 2015 consolidated income statement for Holtz and Devine.

c. If instead the noncontrolling interest shares of Devine had traded for $4.76 surrounding Holtz's acquisition date, what is the impact on goodwill

At year-end, there were no intra-entity receivables or payables.

a. Prepare a worksheet to consolidate these two companies as of December 31, 2015.

b. Prepare a 2015 consolidated income statement for Holtz and Devine.

c. If instead the noncontrolling interest shares of Devine had traded for $4.76 surrounding Holtz's acquisition date, what is the impact on goodwill

Explanation

The excess of fair value over book value...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255