Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 36

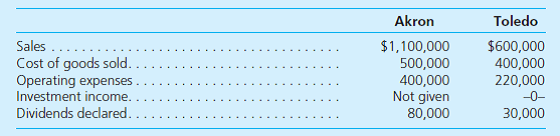

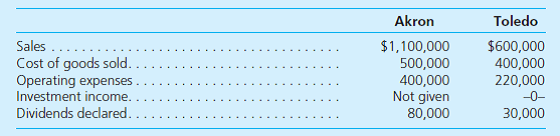

Akron, Inc., owns all outstanding stock of Toledo Corporation. Amortization expense of $15,000 per year for patented technology resulted from the original acquisition. For 2015, the companies had the following account balances:

Intra-entity sales of $320,000 occurred during 2014 and again in 2015. This merchandise cost $240,000 each year. Of the total transfers, $70,000 was still held on December 31, 2014, with $50,000 unsold on December 31, 2015.

a. For consolidation purposes, does the direction of the transfers (upstream or downstream) affect the balances to be reported here

b. Prepare a consolidated income statement for the year ending December 31, 2015.

Intra-entity sales of $320,000 occurred during 2014 and again in 2015. This merchandise cost $240,000 each year. Of the total transfers, $70,000 was still held on December 31, 2014, with $50,000 unsold on December 31, 2015.

a. For consolidation purposes, does the direction of the transfers (upstream or downstream) affect the balances to be reported here

b. Prepare a consolidated income statement for the year ending December 31, 2015.

Explanation

Upstream and Downstream Transfers

Upstr...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255