Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 38

Baxter, Inc., owns 90 percent of Wisconsin, Inc., and 20 percent of Cleveland Company. Wisconsin, in turn, holds 60 percent of Cleveland's outstanding stock. No excess amortization resulted from these acquisitions. During the current year, Cleveland sold a variety of inventory items to Wisconsin for $40,000 although the original cost was $30,000. Of this total, Wisconsin still held $12,000 in inventory (at transfer price) at year-end.

During this same period, Wisconsin sold merchandise to Baxter for $100,000 although the original cost was only $70,000. At year-end, $40,000 of these goods (at the transfer price) was still on hand.

The initial value method was used to record each of these investments. None of the companies holds any other investments.

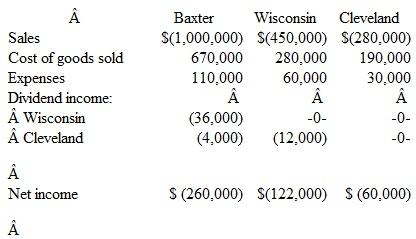

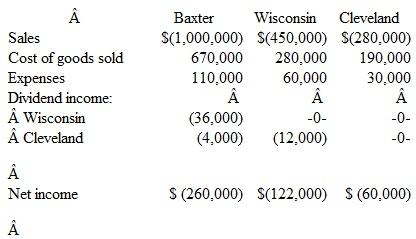

Using the following separate income statements, determine the figures that would appear on a consolidated income statement:

During this same period, Wisconsin sold merchandise to Baxter for $100,000 although the original cost was only $70,000. At year-end, $40,000 of these goods (at the transfer price) was still on hand.

The initial value method was used to record each of these investments. None of the companies holds any other investments.

Using the following separate income statements, determine the figures that would appear on a consolidated income statement:

Explanation

This problem requires knowledge of an in...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255