Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 15

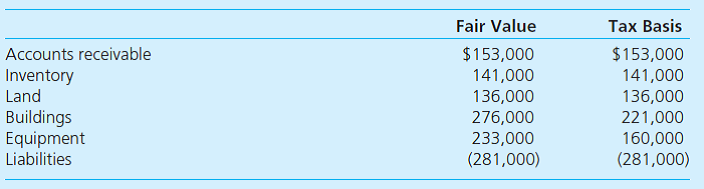

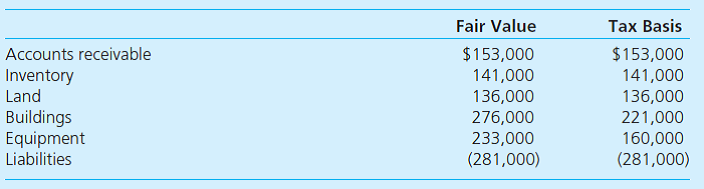

King's Road recently acquired all of Oxford Corporation's stock and is now consolidating the financial data of this new subsidiary. King's Road paid a total of $850,000 for Oxford, which has the following accounts:

a. What amount of deferred tax liability arises in the acquisition

b. What amounts will be used to consolidate Oxford with King's Road at the date of acquisition

c. On a consolidated balance sheet prepared immediately after this takeover, how much goodwill should King's Road recognize Assume a 40 percent effective tax rate.

a. What amount of deferred tax liability arises in the acquisition

b. What amounts will be used to consolidate Oxford with King's Road at the date of acquisition

c. On a consolidated balance sheet prepared immediately after this takeover, how much goodwill should King's Road recognize Assume a 40 percent effective tax rate.

Explanation

K Road acquired all of O Corporation Sto...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255