Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Edition 12ISBN: 978-0077862220 Exercise 44

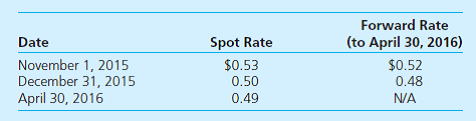

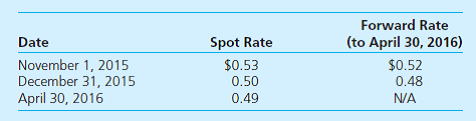

On November 1, 2015, Ambrose Company sold merchandise to a foreign customer for 100,000 FCUs with payment to be received on April 30, 2016. At the date of sale, Ambrose entered into a six-month forward contract to sell 100,000 LCUs. It properly designates the forward contract as a cash flow hedge of a foreign currency receivable. The following exchange rates apply:

Ambrose's incremental borrowing rate is 12 percent. The present value factor for four months at an annual interest rate of 12 percent (1 percent per month) is 0.9610.

a. Prepare all journal entries, including December 31 adjusting entries, to record the sale and forward contract.

b. What is the impact on net income in 2015

c. What is the impact on net income in 2016

Ambrose's incremental borrowing rate is 12 percent. The present value factor for four months at an annual interest rate of 12 percent (1 percent per month) is 0.9610.

a. Prepare all journal entries, including December 31 adjusting entries, to record the sale and forward contract.

b. What is the impact on net income in 2015

c. What is the impact on net income in 2016

Explanation

(a) Prepare all journal entries includin...

Advanced Accounting 12th Edition by Joe Ben Hoyle,Thomas Schaefer , Timothy Doupnik

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255