Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 1

Preparing and Interpreting Financial Statements (Chapters 3 and 5)

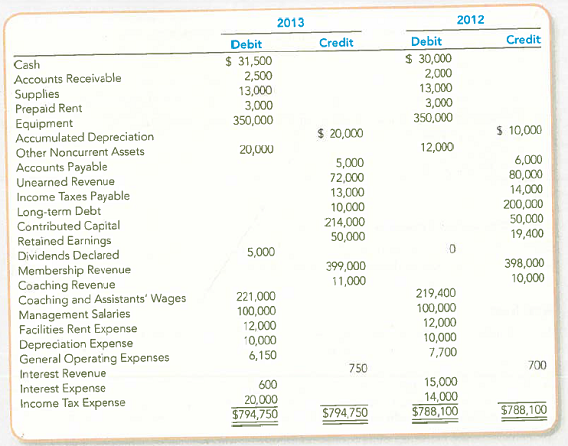

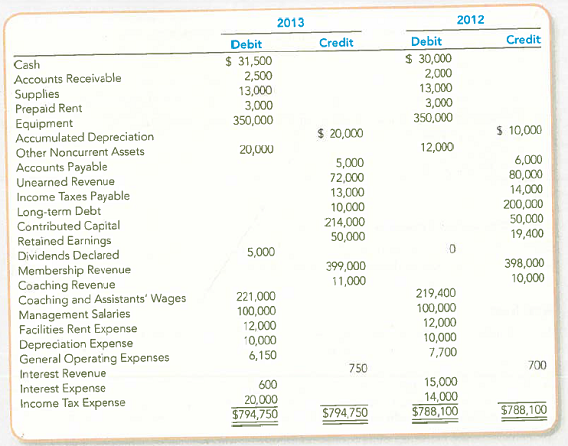

The December 31, 2013 and 2012 adjusted trial balances for Sportlife Gym Corporation are shown or the following page.

Required:

1. Prepare a comparative income statement for 2013 and 2012, a statement of stockholders' equity for 2013, and a comparative classified balance sheet for 2010 and 2012. The income statement should distinguish the gym's core and peripheral results, and group expenses by function (coaching, facilities, and general management). The change in Contributed Capita was caused by the issuance of new stock in 2013.

2. Identify two balance sheet and two income statement accounts that changed significantly in 2013. What might be the cause of these changes

3. Calculate and interpret the debt-to-assets, asset turnover, and net profit margin ratios in 2013 and 2012. Total assets were $400,000 on December 31, 2011.

The December 31, 2013 and 2012 adjusted trial balances for Sportlife Gym Corporation are shown or the following page.

Required:

1. Prepare a comparative income statement for 2013 and 2012, a statement of stockholders' equity for 2013, and a comparative classified balance sheet for 2010 and 2012. The income statement should distinguish the gym's core and peripheral results, and group expenses by function (coaching, facilities, and general management). The change in Contributed Capita was caused by the issuance of new stock in 2013.

2. Identify two balance sheet and two income statement accounts that changed significantly in 2013. What might be the cause of these changes

3. Calculate and interpret the debt-to-assets, asset turnover, and net profit margin ratios in 2013 and 2012. Total assets were $400,000 on December 31, 2011.

Explanation

Comparative Financial Statements

Compar...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255