Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 1

Preparing a Bank Reconciliation and Journal Entries, and Reporting Cash

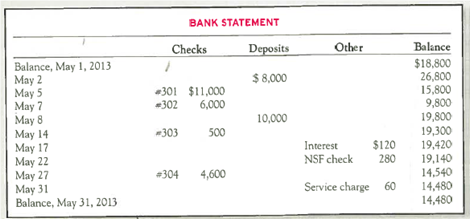

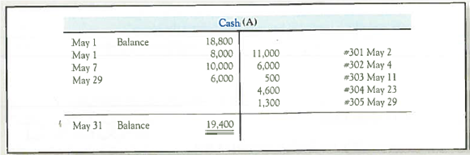

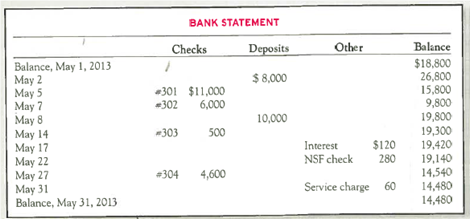

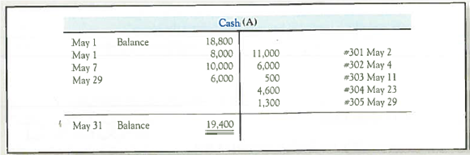

The bookkeeper at Martin Company has asked you to prepare a bank reconciliation as of May 31, 2013. The May 31, 2013, bank statement and the May T-account for cash showed the following (summarized):

Martin Company's bank reconciliation at the end of April 2013 showed a cash balance of $18,800. No deposits were in transit at the end of April, but a deposit was in transit at the end of May.

Required:

1. Prepare a bank reconciliation for May.

2. Prepare any journal entries required as a result of the bank reconciliation. Why are they necessary

3. After the reconciliation journal entries are posted, what balance will be reflected in the Cash account in the ledger

4. If the company also has $50 on hand, which is recorded in a different account called Cash on Hand, what total amount of Cash and Cash Equivalents should be reported on the balance sheet at the end of May

The bookkeeper at Martin Company has asked you to prepare a bank reconciliation as of May 31, 2013. The May 31, 2013, bank statement and the May T-account for cash showed the following (summarized):

Martin Company's bank reconciliation at the end of April 2013 showed a cash balance of $18,800. No deposits were in transit at the end of April, but a deposit was in transit at the end of May.

Required:

1. Prepare a bank reconciliation for May.

2. Prepare any journal entries required as a result of the bank reconciliation. Why are they necessary

3. After the reconciliation journal entries are posted, what balance will be reflected in the Cash account in the ledger

4. If the company also has $50 on hand, which is recorded in a different account called Cash on Hand, what total amount of Cash and Cash Equivalents should be reported on the balance sheet at the end of May

Explanation

1.

The reconciliation statement should ...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255