Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 64

Recording Sales and Purchases with Discounts and Returns and Analyzing Gross Profit Percentage

Larry's Building Supplies (LBS) is a locally owned and operated hardware store. LBS uses a perpetual inventory system.

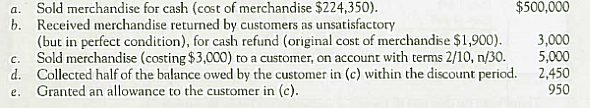

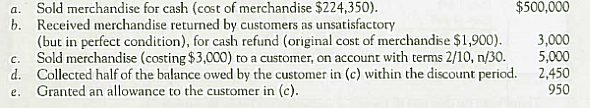

The following transactions (summarized) have been selected from 2013:

Required:

1. Compute Sales Revenue, Net Sales, and Gross Profit for LBS.

2. Compute the gross profit percentage (using the formula shown in this chapter).

3. Prepare journal entries to record transactions ( a )-( e ).

4. LBS is considering a contract to sell building supplies to a local home builder for $20,000. These materials will cost LBS $16,000. Would this contract increase (or decrease) LBS's gross profit and gross profit percentage How should LBS decide whether to accept the contract

Larry's Building Supplies (LBS) is a locally owned and operated hardware store. LBS uses a perpetual inventory system.

The following transactions (summarized) have been selected from 2013:

Required:

1. Compute Sales Revenue, Net Sales, and Gross Profit for LBS.

2. Compute the gross profit percentage (using the formula shown in this chapter).

3. Prepare journal entries to record transactions ( a )-( e ).

4. LBS is considering a contract to sell building supplies to a local home builder for $20,000. These materials will cost LBS $16,000. Would this contract increase (or decrease) LBS's gross profit and gross profit percentage How should LBS decide whether to accept the contract

Explanation

1.

Income statement

________________...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255