Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 39

(Supplement 7B) Analyzing and Interpreting the Effects of Inventory Errors

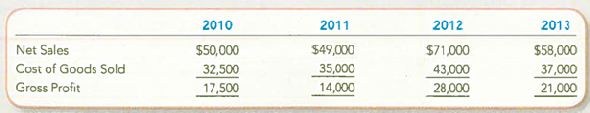

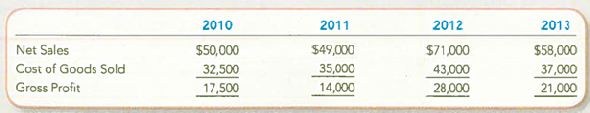

Partial income statements for Murphy Murphy (M M) reported the following summarized amounts:

After these amounts were reported, M M's accountant determined that the inventory on December 31, 2011, was understated by $3,000. The inventory balance on December 31, 2012, was accurately stated.

Required:

1. Restate the partial income statements to reflect the correct amounts, after fixing the inventory error.

2. Compute the gross profit percentage for all four years both ( a ) before the correction and ( b ) after the correction. Does the pattern of gross profit percentages lend confidence to your corrected amounts Explain. Round your answer to the nearest percentage.

TIP: Gross profit percentage is calculated as (Gross Profit ÷ Net Seles) × 100.

Partial income statements for Murphy Murphy (M M) reported the following summarized amounts:

After these amounts were reported, M M's accountant determined that the inventory on December 31, 2011, was understated by $3,000. The inventory balance on December 31, 2012, was accurately stated.

Required:

1. Restate the partial income statements to reflect the correct amounts, after fixing the inventory error.

2. Compute the gross profit percentage for all four years both ( a ) before the correction and ( b ) after the correction. Does the pattern of gross profit percentages lend confidence to your corrected amounts Explain. Round your answer to the nearest percentage.

TIP: Gross profit percentage is calculated as (Gross Profit ÷ Net Seles) × 100.

Explanation

1.

It is observed from the reports of M ...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255