Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Edition 4ISBN: 978-0078025372 Exercise 27

Understanding the Significance of Asset Impairment Losses

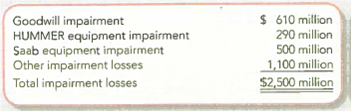

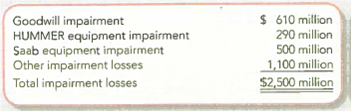

For the year ended December 31, 2008, general Motors Corporation reported a Loss from Operations of $20 billion. The following asset impairment losses were included among its operating expenses.

Do GM 's asset impairment losses seem significant in terms of total dollar value What percentage of the company's 2008 operating loss was explained by asset impairments Why might GM write down its HUMMER and Saab production equipment, but not its Chevrolet production equipment

For the year ended December 31, 2008, general Motors Corporation reported a Loss from Operations of $20 billion. The following asset impairment losses were included among its operating expenses.

Do GM 's asset impairment losses seem significant in terms of total dollar value What percentage of the company's 2008 operating loss was explained by asset impairments Why might GM write down its HUMMER and Saab production equipment, but not its Chevrolet production equipment

Explanation

Impairment loss occurs when the cash inf...

Fundamentals of Financial Accounting 4th Edition by Fred Phillips,Robert Libby,Patricia Libby

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255