Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

Edition 4ISBN: 978-0324380767

Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

Edition 4ISBN: 978-0324380767 Exercise 75

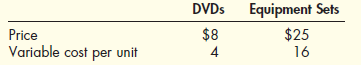

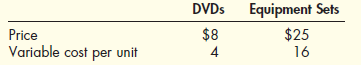

Peace River Products Inc. produces and sells yoga-training products: how-to DVDs and a basic equipment set (blocks, strap, and small pillows). Last year, Peace River Products sold 18,000 DVDs and 4,500 equipment sets. Information on the two products is as follows:

Multiple-Product Breakeven, Break-Even Sales Revenue

Refer to the information for Peace River Products above. Suppose that in the coming year, the company plans to produce an extra-thick yoga mat for sale to health clubs. The company estimates that 9,000 mats can be sold at a price of $18 and a variable cost per unit of $13. Total fixed cost must be increased by $29,100 (making total fixed cost $114,100). Assume that anticipated sales of the other products, as well as their prices and variable costs, remain the same.

Required:

1. What is the sales mix of DVDs, equipment sets, and yoga mats

2. Compute the break-even quantity of each product.

3. Prepare an income statement for Peace River Products for the coming year. What is the overall contribution margin ratio The overall break-even sales revenue

4. Compute the margin of safety for the coming year in sales dollars. (Note: Round the contribution margin ratio to three decimal places; round the break-even sales revenue to the nearest dollar.)

Multiple-Product Breakeven, Break-Even Sales Revenue

Refer to the information for Peace River Products above. Suppose that in the coming year, the company plans to produce an extra-thick yoga mat for sale to health clubs. The company estimates that 9,000 mats can be sold at a price of $18 and a variable cost per unit of $13. Total fixed cost must be increased by $29,100 (making total fixed cost $114,100). Assume that anticipated sales of the other products, as well as their prices and variable costs, remain the same.

Required:

1. What is the sales mix of DVDs, equipment sets, and yoga mats

2. Compute the break-even quantity of each product.

3. Prepare an income statement for Peace River Products for the coming year. What is the overall contribution margin ratio The overall break-even sales revenue

4. Compute the margin of safety for the coming year in sales dollars. (Note: Round the contribution margin ratio to three decimal places; round the break-even sales revenue to the nearest dollar.)

Explanation

1. Sales Mix computation:

Sales mix is t...

Cornerstones of Managerial Accounting 4th Edition by Maryanne Mowen, Don Hansen, Dan Heitger

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255