International Financial Management 2nd Edition by Geert Bekaert ,Robert Hodrick

Edition 2ISBN: 978-0132162760

International Financial Management 2nd Edition by Geert Bekaert ,Robert Hodrick

Edition 2ISBN: 978-0132162760 Exercise 5

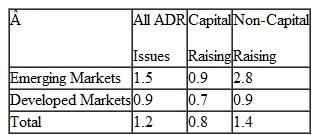

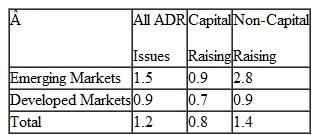

The following table shows how average share prices jump (in percentage) after the announcement that the stocks will be cross-listed (see Miller, 2000). The price response should be interpreted as corrected for risk and market movements that happened on the same day:

Although these numbers appear small, it is important to realize that announcements of domestic equity issues, which by definition raise capital, lead to an average negative return response of 2% to 3%. The main reason is that capital-raising equity issues are viewed as a signal by the managers that the firm may be overvalued in the stock market.

Although these numbers appear small, it is important to realize that announcements of domestic equity issues, which by definition raise capital, lead to an average negative return response of 2% to 3%. The main reason is that capital-raising equity issues are viewed as a signal by the managers that the firm may be overvalued in the stock market.

Given what you learned in this chapter, answer the following:

a. Why is there a positive price response when a company's shares are cross-listed

b. Why might the response for emerging-market firms be larger than for developed-market firms

c. Without knowing that equity issues in a domestic context are associated with negative price responses, is the difference between capitalraising and non-capital-raising ADRs a surprise Why or why not

Although these numbers appear small, it is important to realize that announcements of domestic equity issues, which by definition raise capital, lead to an average negative return response of 2% to 3%. The main reason is that capital-raising equity issues are viewed as a signal by the managers that the firm may be overvalued in the stock market.

Although these numbers appear small, it is important to realize that announcements of domestic equity issues, which by definition raise capital, lead to an average negative return response of 2% to 3%. The main reason is that capital-raising equity issues are viewed as a signal by the managers that the firm may be overvalued in the stock market.Given what you learned in this chapter, answer the following:

a. Why is there a positive price response when a company's shares are cross-listed

b. Why might the response for emerging-market firms be larger than for developed-market firms

c. Without knowing that equity issues in a domestic context are associated with negative price responses, is the difference between capitalraising and non-capital-raising ADRs a surprise Why or why not

Explanation

a) Reason for positive price response wh...

International Financial Management 2nd Edition by Geert Bekaert ,Robert Hodrick

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255