Contemporary Engineering Economics 6th Edition by Chan Park

Edition 6ISBN: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

Edition 6ISBN: 978-0134105598 Exercise 60

Refer to Problem 1 and answer the following questions.

(a) Graph the project balances (at i = 10%) of each project as a function of n.

(b) By examining the graphical results in part (a), determine which project appears to be the safest to undertake if there is some possibility of premature termination of the projects at the end of year 2.

Problem 1

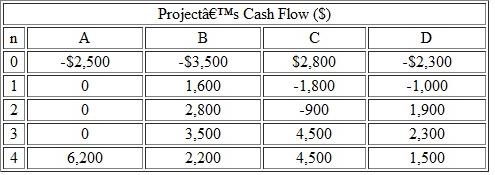

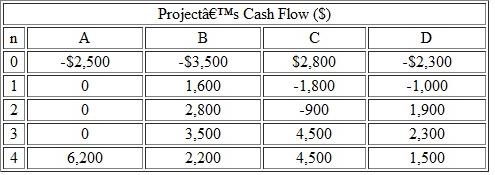

Consider the investment projects in Table 1, all of which have a four-year investment life.

Table 1

(a) What is the payback period of each project

(a) What is the payback period of each project

(b) What is the discounted payback period at an interest rate of 15% for each project

(a) Graph the project balances (at i = 10%) of each project as a function of n.

(b) By examining the graphical results in part (a), determine which project appears to be the safest to undertake if there is some possibility of premature termination of the projects at the end of year 2.

Problem 1

Consider the investment projects in Table 1, all of which have a four-year investment life.

Table 1

(a) What is the payback period of each project

(a) What is the payback period of each project (b) What is the discounted payback period at an interest rate of 15% for each project

Explanation

Project Balance : The net borrowed amoun...

Contemporary Engineering Economics 6th Edition by Chan Park

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255