Contemporary Engineering Economics 6th Edition by Chan Park

Edition 6ISBN: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

Edition 6ISBN: 978-0134105598 Exercise 42

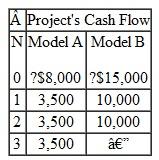

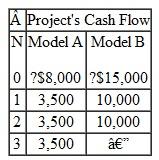

Consider the cash flows for two types of models given in Table.

Both models will have no salvage value upon their disposal (at the end of their respective service lives). The firm's MARR is known to be 12%.

TABLE

(a) Notice that the models have different service lives. However, model A will be available in the future with the same cash flows. Model B is available at one time only. If you select model B now, you will have to replace it with model A at the end of year 2. If your firm uses the present worth as a decision criterion, which model should be selected, assuming that the firm will need either model for an indefinite period

(a) Notice that the models have different service lives. However, model A will be available in the future with the same cash flows. Model B is available at one time only. If you select model B now, you will have to replace it with model A at the end of year 2. If your firm uses the present worth as a decision criterion, which model should be selected, assuming that the firm will need either model for an indefinite period

(b) Suppose that your firm will need either model for only two years. Determine the salvage value of model A at the end of year 2 that makes both models indifferent (equally likely).

Both models will have no salvage value upon their disposal (at the end of their respective service lives). The firm's MARR is known to be 12%.

TABLE

(a) Notice that the models have different service lives. However, model A will be available in the future with the same cash flows. Model B is available at one time only. If you select model B now, you will have to replace it with model A at the end of year 2. If your firm uses the present worth as a decision criterion, which model should be selected, assuming that the firm will need either model for an indefinite period

(a) Notice that the models have different service lives. However, model A will be available in the future with the same cash flows. Model B is available at one time only. If you select model B now, you will have to replace it with model A at the end of year 2. If your firm uses the present worth as a decision criterion, which model should be selected, assuming that the firm will need either model for an indefinite period (b) Suppose that your firm will need either model for only two years. Determine the salvage value of model A at the end of year 2 that makes both models indifferent (equally likely).

Explanation

The fifth chapter of the textbook focuse...

Contemporary Engineering Economics 6th Edition by Chan Park

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255