Contemporary Engineering Economics 6th Edition by Chan Park

Edition 6ISBN: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

Edition 6ISBN: 978-0134105598 Exercise 50

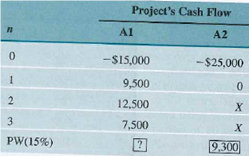

Consider the following two investment alternatives given in Table.

The firm's MARR is known to be 15%.

(a) Compute PW(15%) for project Al.

(b) Compute the unknown cash flow X in years 2 and 3 for project A2.

(c) Compute the project balance (at 15%) of project Al at the end of period 3.

(d) If these two projects are mutually exclusive alternatives, which one would you select

TABLE 53

The firm's MARR is known to be 15%.

(a) Compute PW(15%) for project Al.

(b) Compute the unknown cash flow X in years 2 and 3 for project A2.

(c) Compute the project balance (at 15%) of project Al at the end of period 3.

(d) If these two projects are mutually exclusive alternatives, which one would you select

TABLE 53

Explanation

Table -1 shows the cash flow of 2 differ...

Contemporary Engineering Economics 6th Edition by Chan Park

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255