Contemporary Engineering Economics 6th Edition by Chan Park

Edition 6ISBN: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

Edition 6ISBN: 978-0134105598 Exercise 33

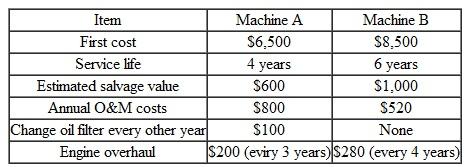

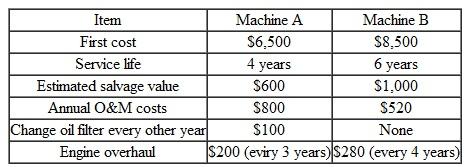

A small manufacturing firm is considering purchasing a new machine to modernize one of its current production Unes. Two types of machines are available on the market. The lives of machine A and machine B are four years and six years, respectively, but the firm does not expect to need the service of either machine for more than five years. The machines have the expected receipts and disbursements given in Table 50.

The firm always has another option: leasing a machine at $3,000 per year, which is fully maintained by the leasing company. After four years of use, the salvage value for machine B will remain at $1,000.

(a) How many decision alternatives are there

(b) Which decision appears to be the best at i = 10%

TABLE 50

The firm always has another option: leasing a machine at $3,000 per year, which is fully maintained by the leasing company. After four years of use, the salvage value for machine B will remain at $1,000.

(a) How many decision alternatives are there

(b) Which decision appears to be the best at i = 10%

TABLE 50

Explanation

Annual equivalent worth

Annual worth ...

Contemporary Engineering Economics 6th Edition by Chan Park

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255