Contemporary Engineering Economics 6th Edition by Chan Park

Edition 6ISBN: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

Edition 6ISBN: 978-0134105598 Exercise 8

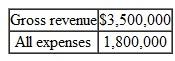

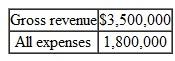

Consider a corporation whose taxable income without state income tax is

If the marginal federal tax rate is 34% and the marginal state rate is 5%, compute the combined state and federal taxes using the two methods described in the text.

If the marginal federal tax rate is 34% and the marginal state rate is 5%, compute the combined state and federal taxes using the two methods described in the text.

If the marginal federal tax rate is 34% and the marginal state rate is 5%, compute the combined state and federal taxes using the two methods described in the text.

If the marginal federal tax rate is 34% and the marginal state rate is 5%, compute the combined state and federal taxes using the two methods described in the text.Explanation

It is given that the marginal tax rate i...

Contemporary Engineering Economics 6th Edition by Chan Park

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255