Contemporary Engineering Economics 6th Edition by Chan Park

Edition 6ISBN: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

Edition 6ISBN: 978-0134105598 Exercise 18

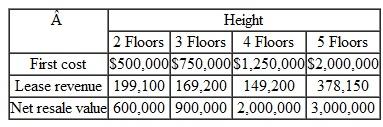

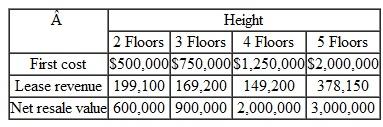

A real-estate developer seeks to determine the most economical height for a new office building, which will be sold after five years. The relevant net annual revenues and salvage values on after-tax basis are as given in Table.

(a) The developer is uncertain about the interest rate ( i ) to use, but is certain that it is in the range

TABLE 4

from 5 to 30%. For each building height, find the range of values of i for which that building height is the most economical.

from 5 to 30%. For each building height, find the range of values of i for which that building height is the most economical.

(b) Suppose that the developer's interest rate is known to be 15%. What would be the cost (in terms of net present value) of a 10% overestimation of the resale value (In other words, the true value was 10% lower than that of the original estimate.)

(a) The developer is uncertain about the interest rate ( i ) to use, but is certain that it is in the range

TABLE 4

from 5 to 30%. For each building height, find the range of values of i for which that building height is the most economical.

from 5 to 30%. For each building height, find the range of values of i for which that building height is the most economical.(b) Suppose that the developer's interest rate is known to be 15%. What would be the cost (in terms of net present value) of a 10% overestimation of the resale value (In other words, the true value was 10% lower than that of the original estimate.)

Explanation

a)

The first question that one would nee...

Contemporary Engineering Economics 6th Edition by Chan Park

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255