Contemporary Engineering Economics 6th Edition by Chan Park

Edition 6ISBN: 978-0134105598

Contemporary Engineering Economics 6th Edition by Chan Park

Edition 6ISBN: 978-0134105598 Exercise 31

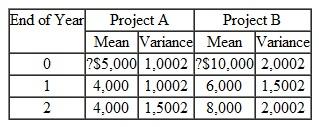

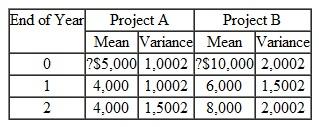

Two mutually exclusive investment projects are under consideration. It is assumed that the cash flows are statistically independent random variables with means and variances estimated as given in Table.

TABLE 24

(a) For each project, determine the mean and standard deviation of the NPW, using an interest rate of 15%.

(a) For each project, determine the mean and standard deviation of the NPW, using an interest rate of 15%.

(b) On the basis of the results of part (a), which project would you recommend

TABLE 24

(a) For each project, determine the mean and standard deviation of the NPW, using an interest rate of 15%.

(a) For each project, determine the mean and standard deviation of the NPW, using an interest rate of 15%.(b) On the basis of the results of part (a), which project would you recommend

Explanation

The twelfth chapter in the textbook asks...

Contemporary Engineering Economics 6th Edition by Chan Park

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255