Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339 Exercise 40

Comparing accrual and cash-basis accounting, preparing adjusting entries, and preparing income statements

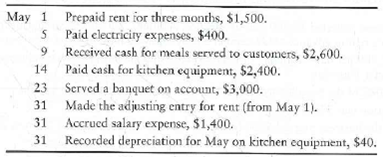

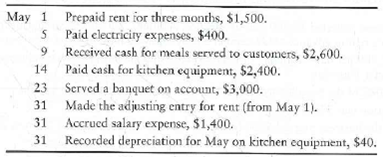

Sweet Catering, Inc., completed the following selected transactions during May, 2012:

Requirements

1. Prepare journal entries for each transaction.

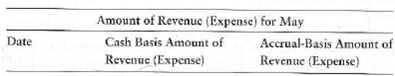

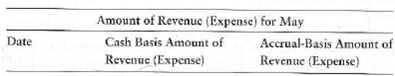

2. Using the journal entries as a guide, show "whether each transaction would be handled as a revenue or an expense using both the accrual and cash basis by completing the following table.

3. After completing the table, calculate the amount of net income or net loss for Sweet Catering under the accrual and cash basis for May.

4. Considering your results from Requirement 3, which method gives the best picture of the true earnings of Sweet Catering Why

Sweet Catering, Inc., completed the following selected transactions during May, 2012:

Requirements

1. Prepare journal entries for each transaction.

2. Using the journal entries as a guide, show "whether each transaction would be handled as a revenue or an expense using both the accrual and cash basis by completing the following table.

3. After completing the table, calculate the amount of net income or net loss for Sweet Catering under the accrual and cash basis for May.

4. Considering your results from Requirement 3, which method gives the best picture of the true earnings of Sweet Catering Why

Explanation

1.

Prepare the journal entries for the g...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255