Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339 Exercise 50

Journalizing purchase and sale transactions-perpetual inventory; making closing entries, and preparing financial statements

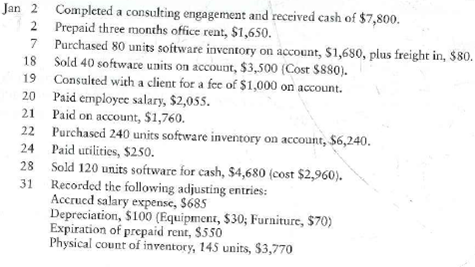

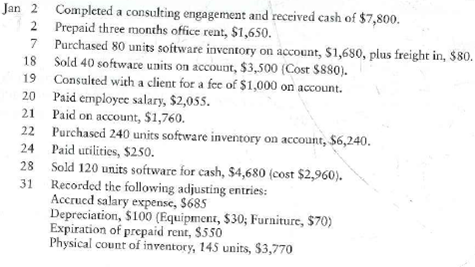

This problem continues the Draper Consulting, Inc., situation from Problem 4-37 of Chapter 4. Draper performs systems consulting. Draper has also begun selling accounting January, Draper Consulting completed the following transactions:

Requirements

1. Open the following selected T-accounts in the ledger: Cash, Accounts receivable, Software inventory, Prepaid rent, Accumulated depreciation, Accounts payable, Salary payable, Common stock, Retained earnings, Dividends, Income summary, Service revenue, Sales revenue, Cost of goods sold, Salary expense, Rent expense, Utilities expense, and Depreciation expense.

2. Journalize and post the January transactions. Key all items by date. Compute each account balance, and denote the balance as BaI.

3. Journalize and post the closing entries. Denote each closing amount as Clo. After posting all closing entries, prove the equality of debits and credits in the ledger.

4. Prepare the January income statement of Draper Consulting. Use the single-step format.

This problem continues the Draper Consulting, Inc., situation from Problem 4-37 of Chapter 4. Draper performs systems consulting. Draper has also begun selling accounting January, Draper Consulting completed the following transactions:

Requirements

1. Open the following selected T-accounts in the ledger: Cash, Accounts receivable, Software inventory, Prepaid rent, Accumulated depreciation, Accounts payable, Salary payable, Common stock, Retained earnings, Dividends, Income summary, Service revenue, Sales revenue, Cost of goods sold, Salary expense, Rent expense, Utilities expense, and Depreciation expense.

2. Journalize and post the January transactions. Key all items by date. Compute each account balance, and denote the balance as BaI.

3. Journalize and post the closing entries. Denote each closing amount as Clo. After posting all closing entries, prove the equality of debits and credits in the ledger.

4. Prepare the January income statement of Draper Consulting. Use the single-step format.

Explanation

Journalizing is the chronological accoun...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255