Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339 Exercise 54

Completing a Merchandiser's Accounting Cycle

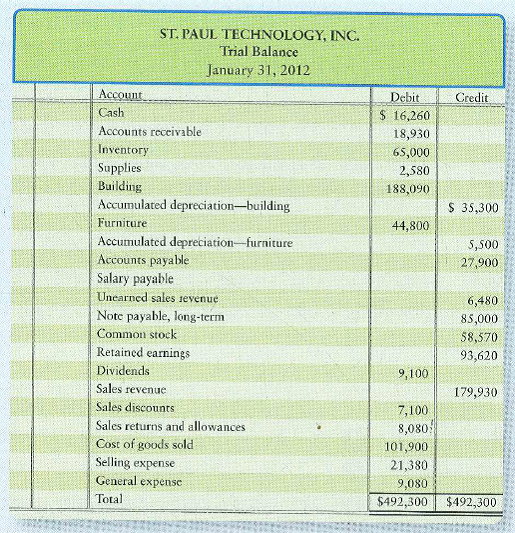

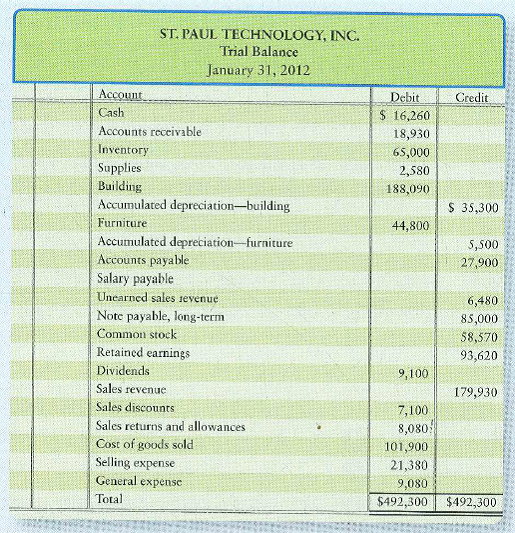

The end-of-month trial balance of St. Paul Technology, Inc., at January 31, 2012, follows:

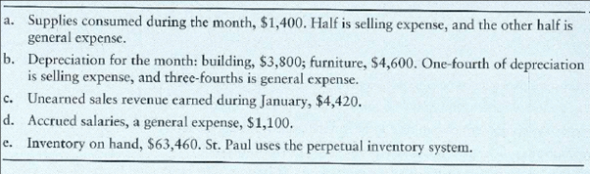

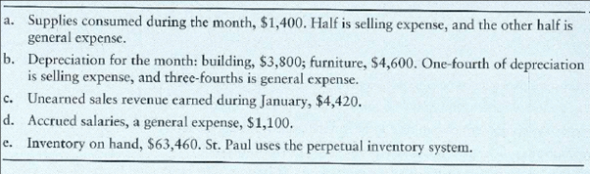

Additional data at January 31, 2012:

Requirements

1. Using four-column accounts, open the accounts listed on the trial balance, inserting their unadjusted balances. Date the balances of the following accounts January 1: Supplies; Building; Accumulated depreciation-building; Furniture; Accumulated depreciation-furniture; Unearned sales revenue; Common stock; and Retained earnings. Date the balance of Dividends, January 31, Also open the Income summary account.

2. Enter the trial balance on a worksheet, and complete the worksheet for the month ended January 31, 2012. St. Paul Technology groups all operating expenses under two accounts, Selling expense and General expense. Leave two blank lines under Selling expense and three blank lines under General expense.

3. Prepare the company's multi-step income statement and statement of retained earnings for the month ended January 31, 2012. Also prepare the balance sheet at that date in report form.

4. Journalize the adjusting and closing entries at January 31.

5. Post the adjusting and closing entries.

The end-of-month trial balance of St. Paul Technology, Inc., at January 31, 2012, follows:

Additional data at January 31, 2012:

Requirements

1. Using four-column accounts, open the accounts listed on the trial balance, inserting their unadjusted balances. Date the balances of the following accounts January 1: Supplies; Building; Accumulated depreciation-building; Furniture; Accumulated depreciation-furniture; Unearned sales revenue; Common stock; and Retained earnings. Date the balance of Dividends, January 31, Also open the Income summary account.

2. Enter the trial balance on a worksheet, and complete the worksheet for the month ended January 31, 2012. St. Paul Technology groups all operating expenses under two accounts, Selling expense and General expense. Leave two blank lines under Selling expense and three blank lines under General expense.

3. Prepare the company's multi-step income statement and statement of retained earnings for the month ended January 31, 2012. Also prepare the balance sheet at that date in report form.

4. Journalize the adjusting and closing entries at January 31.

5. Post the adjusting and closing entries.

Explanation

A balance sheet lists a business entity...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255