Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339 Exercise 46

Accounting for inventory using the perpetual system-FIFO, LIFO, and average cost, and comparing FIFO, LIFO, and average cost

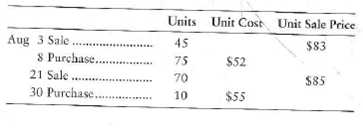

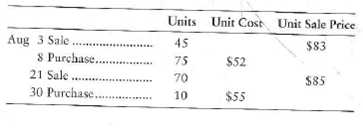

Decorative Steel, Inc., began August with 55 units of iron inventory that cost $35 each. During August, the company completed the following inventory transactions:

Requirements

1. Prepare a perpetual inventory record for the inventory using FIFO.

2. Prepare a perpetual, inventory record for the inventory using LIFO.

3. Prepare a perpetual inventory record for the inventory using average cost.

4. Determine the company's cost of goods sold for August using FIFO, LIFO, and average cost.

5. Compute gross profit for August using FIFO, LIFO, and average cost.

Decorative Steel, Inc., began August with 55 units of iron inventory that cost $35 each. During August, the company completed the following inventory transactions:

Requirements

1. Prepare a perpetual inventory record for the inventory using FIFO.

2. Prepare a perpetual, inventory record for the inventory using LIFO.

3. Prepare a perpetual inventory record for the inventory using average cost.

4. Determine the company's cost of goods sold for August using FIFO, LIFO, and average cost.

5. Compute gross profit for August using FIFO, LIFO, and average cost.

Explanation

1. This exercise requires application of...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255