Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Edition 3ISBN: 978-0132962339 Exercise 51

Computing periodic inventory amounts

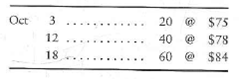

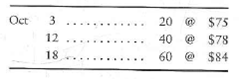

A Tomorrows Electronic Center began October with 90 units of inventory that cost $70 each. During October, the store made the following purchases:

Tomorrows uses the periodic inventory system, and the physical count at October 31 indicates that 110 units of inventory are on hand.

Requirements

1. Determine the ending inventory and cost of goods sold amounts for the October financial statements using the average cost, FIFO, and LIFO methods.

2. Sales revenue for October totaled $26,000. Compute Tomorrows' gross profit for October using each method.

3. Which method will result in the lowest income taxes for Tomorrows Why Which method will result in the highest net income for Tomorrows Why

A Tomorrows Electronic Center began October with 90 units of inventory that cost $70 each. During October, the store made the following purchases:

Tomorrows uses the periodic inventory system, and the physical count at October 31 indicates that 110 units of inventory are on hand.

Requirements

1. Determine the ending inventory and cost of goods sold amounts for the October financial statements using the average cost, FIFO, and LIFO methods.

2. Sales revenue for October totaled $26,000. Compute Tomorrows' gross profit for October using each method.

3. Which method will result in the lowest income taxes for Tomorrows Why Which method will result in the highest net income for Tomorrows Why

Explanation

Net sales revenue is sales revenue less ...

Financial & Managerial Accounting 3rd Edition by Charles Horngren,Harrison, Walter,Suzanne Oliver

Why don’t you like this exercise?

Other Minimum 8 character and maximum 255 character

Character 255